Alternative Mutual Funds 3

“I can’t stress enough: Boards are now being asked to look at things in great detail,” said Kathleen Moriarty, Partner at Katten Muchin Rosenman LLP. “We spend a lot of time educating the Board,” she said, referring to the Board of Directors of alternative mutual funds. It’s simply that the Board is required to understand the fund at a deeper level than ever before. Moriarty was the third of three speakers at a GARP-sponsored webinar on Alternative Mutual Funds: Risk Governance Under SEC Security on February 17, 2015. She described a recent instance of going over the legislation on mutual […]

Alternative Mutual Funds 2

“SEC’s mission is to protect investors and support responsible capital formation,” said Raymond Slezak, Assistant Regional Director at the Securities and Exchange Commission (SEC). He was the second of three presenters at the GARP-sponsored webinar held February 17, 2015, on Alternative Mutual Funds: Risk Governance Under SEC Security. Liquid alternative mutual funds were “listed as a priority” as early as 2013, he said, because “any time there’s rapid growth” or “concern about the dynamics of money managers moving into an area,” it attracts SEC interest. As a metaphor about the regulatory thought about the new funds, Slezak repeated a quotation […]

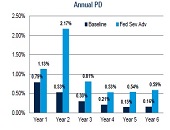

Stress Testing Mortgages. Part 2

The team of Scott L. Smith, Jesse Weiher, and Debra Fuller at the Federal Housing Finance Agency (FHFA) use specialized financial models to estimate potential losses. They carried out empirical tests of countercyclical shocks using four different models of mortgage credit risk. This posting continues a February 4, 2015, presentation by Scott L. Smith to an audience of financial risk managers at Global Association of Risk Professionals (GARP). Two models were devised at FHFA, and two are commercially available credit models: one, called Black Knight (formerly LPS-AA), and the other called ADCO Loan Dynamics. The estimated losses were converted to a capital […]

Stress Testing Mortgages. Part 1

“One needs to be careful and not over-reliant on any one model,” said Scott L. Smith, Associate Director for Capital Policy at the Federal Housing Finance Agency (FHFA). He was referring to the financial models used by major financial institutions to estimate potential losses. On February 4, 2015, he was presenting a GARP-sponsored webinar on countercyclical stress tests to set capital requirements. Smith explained how credit risk is measured for mortgages, and described a way to embed stress testing that uses countercyclical concepts. He and colleague Jesse Weiher, Senior Economist at FHFA, performed dynamic stress testing that was adjusted to […]

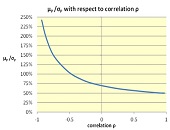

Correlation Risk

“Before we argue about correlation, we must first agree on which interpretation we are talking about,” said Gunter Meissner, President of Derivatives Software, Founder and CEO of Cassandra Capital Management, and Adjunct Professor of Mathematical Finance at NYU-Courant. He was sole presenter at a webinar on October 21, 2014, sponsored by GARP. Meissner cited three different interpretations commonly used for correlation risk. “In trading practice, it can mean similar movement in time. Or it can be narrowly defined,” he said, “to only refer to the linear Pearson definition.” Third, it can be used in the broader sense of any type […]

DFAST 1. Modeling Losses and Provisions Over Time

Although Dodd-Frank Act Stress Testing (DFAST) requirements may be the primary motivation for bringing stress testing to the forefront, they should not be the only reason a bank explores the components of loan loss forecasting under a stressed scenario, said Chris Henkel, Senior Director, Enterprise Risk Solutions at Moody’s Analytics. He was the first of two panelists at a webinar held on September 9, 2014, sponsored by the Global Association of Risk Professionals. An accurate forecast of charge-offs is crucial, Henkel said, so that a firm “can estimate what allowances should be and how large the provisions should be,” thereby […]

Risk Units & Risk Accounting

“In the absence of a standardized and universally accepted method of calculating exposure to risk, are accuracy, integrity and timeliness achievable?” asked Peter Hughes, Managing Director, Financial InterGroup (UK). He was the fourth of four panellists to present at the GARP webinar on risk data aggregation held July 22, 2014. Hughes was speaking with reference to the Basel Committee on Banking Supervision (BCBS) article 239, which spells out principles of accuracy, integrity, and timeliness for risk data. There’s a mixed bag of methods used to identify and quantify exposure to risk, Hughes noted. Quantitative modelling, accounting methods, key risk indicators, […]

Where is the Common Thread?

Thanks to “Rube Goldberg infrastructure” and a lack of attention, banks “have been mixing together data that have no common thread,” said Allan D. Grody, founder of Financial InterGroup Holdings. “Now is our chance to fix the plumbing.” Grody was the third of four panellists to address the July 22, 2014 GARP webinar on changes to risk data aggregation and reporting. His talk continued a theme of improved risk data management that he has spoken about before to GARP audiences. The “astonishing” aftermath of the 2008 Lehman fiasco—where banks were scrambling to determine exposure to a bankrupt counterparty—“has become the […]

Challenges to Risk Data Aggregation: Overview

Will financial institutions be able to respond to new challenges of risk data aggregation, reporting and record-keeping? Peter J. Green, Partner of Morrison & Foerster LLP, opened the four-panellist webinar organized by GARP on July 22, 2014, to discuss new risk data aggregation, risk reporting and recordkeeping principles. He indicated that the recent financial crisis had caused regulators to see many gaps in risk reporting and aggregation due to deficiencies in banks’ IT and data architecture. The Financial Stability Board (FSB) gave a mandate to the Basel Committee on Banking Supervision (BCBS) “to develop principles for effective risk data aggregation […]

Counterparty Credit Risk 2. The Good, the Bad, the Ugly, and the Unseen

“Data and its accuracy are key to making this work,” said Robert Scanlon, referring to counterparty credit risk. Scanlon is the former Group Chief Credit Officer of Standard Chartered Bank and current Principal, Scanlon Associates. As the second of three speakers at a GARP webinar on counterparty risk held on May 20, 2014, Scanlon spoke from years of experience with risk practices. First, the good part of calculating counterparty credit risk. Scanlon said there is plenty of data already, especially for consumer/retail transactions. “You can start with a steady state assumption and get more data as time goes on. Ask […]