A New Landscape

Jay Clayton, the recently appointed chair of the U.S. Securities and Exchange Commission (SEC) under President Trump, has signaled new directions in the enforcement of securities laws. What are the implications for financial risk managers? “There is shift away from ‘broken windows’—trying the smallest cases—and there is no longer a requirement for companies to admit wrongdoing,” said Amy Poster, Managing Principal at Alpha Pacific Strategies. She was the moderator and opening speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. The SEC appears to be changing its […]

Geopolitical Risk

What’s with Russia and cyber-hacking? How did it happen, and why? Geopolitical risk threatens the very fundamentals of market stability and the world order. The Global Association of Risk Professionals treated its members to a “big picture” risk topic during the webinar on November 1, 2017. Former senior US intelligence officer Jack Thomas Tomarchio, who is now a principal with the Agoge Group, LLC, described the current geopolitical risk due to Russian cyber-attacks. “Russia was declared to be responsible for leaks at the Democratic National Convention in 2016,” Tomarchio said. “The DNC is supposed to be neutral, but the leaks […]

The Dawn of the Mega-Platform

Disruption of the financial sector is just on the horizon, says Haydn Shaughnessy, author and innovation specialist. He presented a webinar on “The Rise of Mega-Platforms and the Risks to Banking” to the Global Association of Risk Professionals (GARP) on May 25, 2016. His books include The Elastic Enterprise, Shift, and (most recently) Platform Disruption Wave. “What are the consequences of the disintegration of industry structures?” Shaughnessy asked. Most people see innovation as trying to get more of something that’s desirable, he said, but they might not understand clearly where they are headed. In short, what is the “big picture” […]

Platform of the Future

What will be the ideal modelling platform of future bankers? It will need to contain key functionalities in model execution, scenario management, and a “risk engine” that will deliver answers for multiple horizons at the loan level. Furthermore, it should implement the most advanced modelling suites, reduce the quants’ time to develop models, and contain simulation capabilities for stress testing and beyond. This bold vision of the future was presented by Martim Rocha, Advisory Business Solution Manager at SAS. He was the second of two presenters at the February 25, 2016, webinar offered by the Global Association of Risk Professionals […]

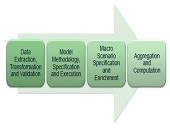

Integrated Data and Modelling

How can today’s bankers prepare for tomorrow’s challenges? Consider the financial models built using available data. Data collection and financial modelling used to be conducted in each different silos of the bank, with credit separate from market, which was separate from treasury and other groups). Then data became “managed” and modelling was moved to “platforms” which did not mix well between the various silos. A few brave souls began to integrate the data management for different groups of the bank. Other brave souls tried to integrate the modelling. This was the phase of integration achieved through batch calculations. Now, the […]

“Not Only The What But The How”

When it comes to financial data for stress testing, there’s a good news-bad news aspect. The good news may be that a bank did not suffer severe financial stress but the bad news is that it will be harder for the bank to model “bad events” if it does not have such data. And banks “will get written up if [the regulators] don’t believe their bad events,” said Tara Heusé Skinner, Manager at SAS Risk Research & Quantitative Solutions, and co-author of The Bank Executive’s Guide to Enterprise Risk Management. She was the first presenter of two at the May […]

Alternative Mutual Funds 1

Alternative mutual funds have been experiencing a growth “nothing short of phenomenal,” said Amy Poster, Director of Financial Services Advisory at Berdon LLP, “and this has not escaped the notice of the Office of Compliance Inspections and Examinations (OCIE).” She was the first of three speakers in a webinar about alternative mutual funds held on February 17, 2015, and sponsored by the Global Association of Risk Professionals (GARP). She pointed to a 2014 Barclays study, Developments and Opportunities for Hedge Fund Managers in the ’40 Act Space , that estimated assets controlled by liquid alternative funds would reach between $USD […]

Where is the Common Thread?

Thanks to “Rube Goldberg infrastructure” and a lack of attention, banks “have been mixing together data that have no common thread,” said Allan D. Grody, founder of Financial InterGroup Holdings. “Now is our chance to fix the plumbing.” Grody was the third of four panellists to address the July 22, 2014 GARP webinar on changes to risk data aggregation and reporting. His talk continued a theme of improved risk data management that he has spoken about before to GARP audiences. The “astonishing” aftermath of the 2008 Lehman fiasco—where banks were scrambling to determine exposure to a bankrupt counterparty—“has become the […]

Challenges to Risk Data Aggregation: Overview

Will financial institutions be able to respond to new challenges of risk data aggregation, reporting and record-keeping? Peter J. Green, Partner of Morrison & Foerster LLP, opened the four-panellist webinar organized by GARP on July 22, 2014, to discuss new risk data aggregation, risk reporting and recordkeeping principles. He indicated that the recent financial crisis had caused regulators to see many gaps in risk reporting and aggregation due to deficiencies in banks’ IT and data architecture. The Financial Stability Board (FSB) gave a mandate to the Basel Committee on Banking Supervision (BCBS) “to develop principles for effective risk data aggregation […]