Top 5 Trends in Risk Management

The champagne has been drunk, and the New Year has been rung in. What trends are predicted in risk management as we welcome the new decade? “In 2020, we’ll likely see significant changes in risk models, processes and functions,” predicts Brenda Boultwood, Risk Advisory Partner at Deloitte. As a senior expert in risk culture and corporate governance, she published an article online January 10, 2020, for the Global Association of Risk Professionals (GARP). We present the highlights and a link to the full article below. The three lines of defense business model, as we know it, will end This is actually […]

A Good Start…

Financial risks due to climate change are receiving more attention of late, particularly for investors and regulators, but how far along are firms in addressing the issues? A report on climate risk management at financial firms tabled on June 28, 2019, sponsored by the Global Association of Risk Professionals (GARP), answers the question with its subtitle: “A Good Start, But More Work to Do.” The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP. “Our sample covered 20 banks and seven other financial institutions … from across the globe. These firms have a global […]

Winds of Change

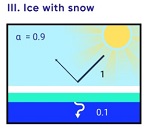

“Will the greater intensity of climate change expected in Canada produce a greater impact on Canadian financial institutions, and firms that hold a greater proportion of exposure to Canada in its portfolio?” This was the question posed by Robert Thomas, risk consultant to the non-profit organization Ontario Conservation Now as part of a round table held at the Toronto Public Library on April 18, 2019. A report[1] tabled earlier this month by Environment Canada says that climate change will have a greater effect on Canada than on most countries. The report, Canada’s Changing Climate Report 2019 (CCCR2019), looked at observed […]

Barcodes of Finance 4

7. Will blockchain technology affect the drive toward barcodes? It most definitely should—and in a positive way. The maintenance of a distributed database of identifiers, both for participants and products traded throughout the global financial supply chain is the easiest global blockchain infrastructure application to be developed. A global database of all the world’s participant and product identifiers, maybe a half billion records, is limited in scale, both as to data recorded in its distributed ledger and in its limits of processing speed—seconds required, at the most. Both parameters of speed and scale are well within the boundaries of current […]

Barcodes of Finance 3

5. Great, the G20 set up the Financial Stability Board to set things straight. So, what’s the problem? It was thought by all that “regulatory compulsion” at such a global level, overseen by the world’s most prominent collection of leaders of the largest economies, would finally solve the collective action problem that stymied the industry from doing this on their own. Industry members could not justify stepping aside from each firm’s own self-interest in maintaining the status quo. It would be costly to re-engineer legacy systems built in convoluted increments over the previous six decades. Everyone without exception wanted to […]

Barcodes of Finance 2

3. What allowed non-standard transaction date to persist and what was your response? I had spent my whole career in various sectors of finance and as an advisor to many financial institutions as a consulting Partner with PwC, responsible for the Financial Services sector. I saw the same sets of transaction data described differently in each firm, even though they would need to match perfectly between firms in order to confirm the transaction with the counterparty and either receive payment or pay for it. This disorder was managed by delaying the payment until all the details were reconciled, first by […]

Barcodes of Finance 1

After the holidays, Morty was bragging he’d been out to a new, very swanky seafood restaurant. “The maître d’ said they’re planning to bring in seafood barcodes.” I immediately pictured a slab of fish on Styrofoam with the price barcode sticker on it—straight from my local supermarket. “And this is at a high-end place?” I said skeptically. “Yeah, but it’s an identifier code, not a price sticker. It’s so the customer can verify they’re getting what they’re paying for,” he said. “Apparently there’s a big push to identify species, and make the information available.” Talking about fish barcodes reminded me […]

Shifting Energy Markets

How are strategic priorities in energy markets shifting? What are the risk management implications? “Geopolitical risks have worsened and technological innovation is causing more disruption,” said Medy Agami, senior partner and vice-chairman at Ben-Roz and Associates and co-founder of the consulting firm Opimas. He was the sole presenter of the webinar “Energy Market Strategy and Risk Playbook: How to prosper amid a wave of disruptive innovation, geopolitical uncertainty, market volatility & exponentially growing risk landscape in 2018 & beyond” sponsored by the Global Association of Risk Professionals (GARP) on August 7, 2018. “There are five main forces acting on fundamentally shifting markets,” […]

Geopolitical Risk

What’s with Russia and cyber-hacking? How did it happen, and why? Geopolitical risk threatens the very fundamentals of market stability and the world order. The Global Association of Risk Professionals treated its members to a “big picture” risk topic during the webinar on November 1, 2017. Former senior US intelligence officer Jack Thomas Tomarchio, who is now a principal with the Agoge Group, LLC, described the current geopolitical risk due to Russian cyber-attacks. “Russia was declared to be responsible for leaks at the Democratic National Convention in 2016,” Tomarchio said. “The DNC is supposed to be neutral, but the leaks […]

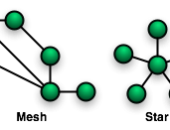

Central Clearing Design

If you had to design a central clearinghouse for transactions in financial markets, what size of guarantees should be offered? And what percentage fees should be charged? “The central clearing modifies the market,” said Andreea Minca, “because the old network structure [of one-to-one] is changing to a new ‘star’ structure.” Minca is Assistant Professor at the School of Operations Research and Information Engineering at Cornell University and was the sole presenter at the December 6, 2016, webinar on systemic risk and central clearing design to members of the Global Association of Risk Professionals (GARP). Under new US legislation, all over-the-counter […]