Avoid Jekyll and Hyde

Accurate price determination for commodities means that data must be gathered, processed and analyzed. What, then, are current best practices for data management? “Organizations are beginning to recognize their current solutions are no longer meeting current needs,” said Michal Peliwo, Vice President of Business Solutions at ZE PowerGroup. He was the third and final speaker at a webinar on August 24, 2016, sponsored by the Global Association of Risk Professionals, titled “The Price is Right? Strategies for Market Discovery & Optimum Pricing Challenges.” Peliwo described the fragmented world of data management as it exists at most companies. “MS Excel is […]

Optimum Price a Moving Target

How was risk-taking originally priced, and has this changed over time? Centuries ago, mercantile economies used to pool risk for the trading ships that were sent out. Over time, this “big chunk risk” has given way to increasingly more precise ways of determining risk, and is now down to individual financial transactions. “Pricing is the centre of gravity of this operation,” said Robin Bloor, Chief Analyst at The Bloor Group. “For every product theoretically there is an optimum price.” Beginning with this historical comparison, he was the first of three speakers at a webinar on August 24, 2016, sponsored by […]

Fast Turnaround of Complex Math

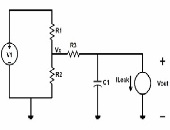

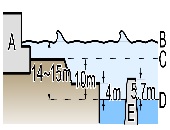

Imagine you are driving your brand-new mini-van, the latest Drake album cranked on high, the windshield wipers at top tempo, and the heater keeping things toasty. You go to switch the headlights to high-beam—and you are suddenly hit by the unmistakable odour of melting circuits…. Not a happy situation. It’s one that automotive designers the world over try to avoid by extensive testing of many different usage scenarios. Problem-solving tools have dramatically changed the way engineers advance their knowledge, for financial, automotive, chemical, and other sectors. Many products and technologies we take for granted—such as the electronic circuitry in a […]

Worst Case Analysis Made Easy

Can symbolic computing improve real-world design? Definitely yes, according to the product development team at the automotive firm Delphi. “Each time the circuits were changed, the electrical equations changed. We turned to symbolic computing so that we could quickly deal with design changes,” said Michael G. McDermott, Senior Development Engineer at Delphi. He was the second speaker in a webinar on May 25, 2016, titled “How Far Can Your Math Knowledge Go?” Lights, heating, movies for kids in the back to watch… Over time, vehicles have come to have more and more elaborate electronics. These can lead to unpredictable stresses […]

Three-Way Damage

Do you remember that cute VW video, “The Force”? The one where the little boy, dressed up as Darth Vader, can’t get a reaction from anyone or anything, even his dog, when he tries his super-powers on them? Then, Dad drives up in his VW Passat and the Vader-wannabe is, magically, able to get the lights to flash. The camera pans to parents looking out the window. Dad gives a conspiratorial grin as he clicks the remote control. On September 18, 2015, world markets were rocked by news that Volkswagen had knowingly falsified its emissions of toxic nitrogen oxides. The […]

What is Key to Integrating Op Risk?

“It’s critical to unite multiple perspectives on risk,” said Brenda Boultwood, Senior Vice President at MetricStream, “even though approaches to risk and compliance can be very different” throughout an organization. Boultwood was the second of two speakers at a webinar on operational risk held on August 27, 2015, sponsored by the Global Association of Risk Professionals. A common framework will require standard taxonomies, common definitions, and consistent risk assessment across a company, said Boultwood. She sketched out an integrated enterprise risk management (ERM) framework, in which all types of risk share a common hierarchy, common business processes, and a common […]

Is it OpRisk? or Business Risk?

Operational risk has figured prominently in the business news this summer: a lightning storm destroyed cloud data stored by Google, and a cyber-hack of dating website Ashley Madison breached confidentiality of 33 million accounts. Are companies addressing operational risk the best way possible? What is called operational risk may in fact have its roots in business risk, according to Mike Finlay, Chief Executive of RiskBusiness International. He was the first of two speakers at a webinar on operational risk held on August 27, 2015, sponsored by the Global Association of Risk Professionals. For example, the 2011 Fukushima Daiichi disaster in […]

One Size Does Not Fit All

When it comes to risk reporting, do you ever feel that you are trying to push a square peg into a round hole? According to Gordon Goodman, that may happen rather often for companies that are not in the finance industry. Goodman, Director of Governance and Enterprise Risk Management at NRG Energy, was the first of two presenters at the June 16, 2015, webinar on Effective Risk Reporting sponsored by the Global Association of Risk Professionals. According to Goodman, there has been a push by banks to “bring their metrics to the marketplace, but this has created problems” for non-financial […]

Four Lessons from Stress Testing Exercise

“It very quickly became apparent that this was not a one- or two-month exercise,” said Charyn Faenza, Vice President, Manager of Corporate Business Intelligence Systems at First National Bank, the largest subsidiary of the largest subsidiary of FNB Corporation. She was the second of two presenters at the May 19, 2015, webinar on Stress Testing Modeling sponsored by the Global Association of Risk Professionals. Faenza was referring to her bank’s experience as an example of a “DFAST 10-50” bank that is required to conduct an annual stress test. She drew four important lessons from the exercise. Good Modeling Requires Good […]

Update on Central Clearing

One of the goals of the Dodd-Frank Act is to mitigate systemic financial risk by establishing a central clearinghouse for derivatives. But how close is the financial community toward achieving that goal? “Many swaps were not collateralized prior to Dodd-Frank,” said Julian E. Hammar, Of Counsel at Morrison & Foerster. Hammar was the third of four presenters at the Derivatives Regulatory Update webinar held on March 31, 2015, sponsored by the Global Association of Risk Professionals. Clearing swaps mitigates risk not just through requiring margin collateral (and thereby reducing) credit risk. It also imposes an “operational discipline” Hammar said, with […]