Effective Risk Reporting

Effective risk reporting means “having the intelligence at your fingertips but exercising the judgment to report only what your company needs,” said Elizabeth Abraham, Director of Professional Services at MetricStream, and the second of two presenters at the June 16, 2015, webinar on Effective Risk Reporting sponsored by the Global Association of Risk Professionals. “Lack of clarity about the reporting objective” is a common barrier to effective enterprise risk management reporting, she said. Make sure you understand what level of information the audience wants. “Data model inconsistencies can lead to an inability to aggregate” the risk estimates, and that’s another […]

One Size Does Not Fit All

When it comes to risk reporting, do you ever feel that you are trying to push a square peg into a round hole? According to Gordon Goodman, that may happen rather often for companies that are not in the finance industry. Goodman, Director of Governance and Enterprise Risk Management at NRG Energy, was the first of two presenters at the June 16, 2015, webinar on Effective Risk Reporting sponsored by the Global Association of Risk Professionals. According to Goodman, there has been a push by banks to “bring their metrics to the marketplace, but this has created problems” for non-financial […]

Four Lessons from Stress Testing Exercise

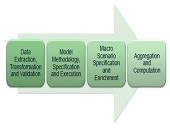

“It very quickly became apparent that this was not a one- or two-month exercise,” said Charyn Faenza, Vice President, Manager of Corporate Business Intelligence Systems at First National Bank, the largest subsidiary of the largest subsidiary of FNB Corporation. She was the second of two presenters at the May 19, 2015, webinar on Stress Testing Modeling sponsored by the Global Association of Risk Professionals. Faenza was referring to her bank’s experience as an example of a “DFAST 10-50” bank that is required to conduct an annual stress test. She drew four important lessons from the exercise. Good Modeling Requires Good […]

“Not Only The What But The How”

When it comes to financial data for stress testing, there’s a good news-bad news aspect. The good news may be that a bank did not suffer severe financial stress but the bad news is that it will be harder for the bank to model “bad events” if it does not have such data. And banks “will get written up if [the regulators] don’t believe their bad events,” said Tara Heusé Skinner, Manager at SAS Risk Research & Quantitative Solutions, and co-author of The Bank Executive’s Guide to Enterprise Risk Management. She was the first presenter of two at the May […]

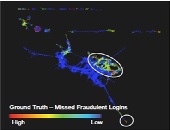

Better Living Through Topology

“It gets downright annoying when I’m just trying to check my e-mail but I get prompted to answer three security questions,” said Alexis Johnson, voicing a concern shared by many in the audience when fraud detection is so overblown it obstructs ordinary use of software. Johnson, Director of Technical Sales at the big data analytics firm Ayasdi, was the second of two presenters at a webinar on the topic “The Fraud Arms Race” sponsored by the Global Association of Risk Professionals on April 21, 2015. When it comes to detecting fraud in big data, “data complexity, not volume, is the […]

The Fraud Arms Race: Neck and Neck

“It’s the fraud axiom: all the things we do to make things easier for the consumer also make things easier for the crooks,” said Randall Casciello, Advanced Analytics Senior Manager at the management consulting firm Accenture. He was the first of two presenters at a webinar on the topic “The Fraud Arms Race” sponsored by the Global Association of Risk Professionals on April 21, 2015. Fraud from payment cards costs the financial services industry around $12 billion annually, and is increasing at an alarming rate, about 15 percent annually, according to the Nilson Report. Casciello said fraud spans a wide […]

Aligning Risk Appetite. Part 2

To succeed, a company must take risk, but how can it keep a close enough watch to make sure the risks do not demolish its very existence? After Chris Mandel described the risk appetite framework in part 1 of this posting, Brenda Boultwood, Senior Vice President of Industry Solutions at MetricStream, took the floor to describe how technology can make it happen. She was the second of two presenters at the webinar “Aligning Risk Appetite with ERM Governance” sponsored by the Global Association of Risk Professionals on March 17, 2015. Boultwood said that risk assessment can be a “unifying call” […]

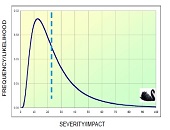

Aligning Risk Appetite. Part 1

“How can you manage risk without understanding risk appetite?” asked Chris Mandel, SVP Strategic Solutions at Sedgwick, Inc. He was the first of two presenters at the webinar “Aligning Risk Appetite with ERM Governance” sponsored by the Global Association of Risk Professionals on March 17, 2015. “Some people ask why do I have to go through a bureaucratic exercise,” Mandel said, pointing out that there are real advantages to developing a risk appetite framework (RAF). Risk appetite management is expected more and more often by regulators, credit rating agencies, institutional investors, and internal auditors. “Missing the connection between risk and […]

Tailoring Risk Model to Investment Strategy

Due to the growing complexity of measuring financial risk, “risk has become a patchwork” of different models, said Phil Jacob, Senior Director at Axioma Risk Research. He was the sole presenter in a webinar about tailoring the right risk model to your investment strategy held on March 4, 2015, and sponsored by the Global Association of Risk Professionals (GARP). Jacob identified four inherent challenges. “There are operational issues stemming from existing rigid approaches,” leading to “difficulty in aggregating risk.” There is a lack of consistency in modeling portfolios, which can run the gamut from very simple proxies all the way […]

Alternative Mutual Funds 3

“I can’t stress enough: Boards are now being asked to look at things in great detail,” said Kathleen Moriarty, Partner at Katten Muchin Rosenman LLP. “We spend a lot of time educating the Board,” she said, referring to the Board of Directors of alternative mutual funds. It’s simply that the Board is required to understand the fund at a deeper level than ever before. Moriarty was the third of three speakers at a GARP-sponsored webinar on Alternative Mutual Funds: Risk Governance Under SEC Security on February 17, 2015. She described a recent instance of going over the legislation on mutual […]