Risk Ratings 2. “Hundreds of Spreadsheets”

“There were hundreds of different spreadsheet templates floating around,” said Christopher Hansert, Product Manager at Bosch Software Innovations, and the second of two presenters at a GARP webinar on the impact of new capital rules on risk ratings, held June 24, 2014. He presented a case study of an unnamed US commercial bank. Due to an acquisition during the period of regulatory change, he said that the bank had a “heterogeneous set of platforms, models, and inconsistent ratings. They wanted one robust and centralized” risk rating system. Inconsistencies in the risk rating process increased the likelihood of error, Hansert pointed […]

Risk Ratings 1. The Big Choke Points

“The inter-connectedness of the regulatory landscape has increased dramatically,” said Balachander Lakshmanan, Director at Deloitte & Touche LLP. He was the first of two presenters at the June 24, 2014, webinar sponsored by the Global Association of Risk Professionals to discuss the impact of capital rules on risk rating systems. In the wake of the financial crisis, new regulations—Basel, Volcker rule, Comprehensive Capital Analysis and Review (CCAR)—have proliferated. Due to changes in capital rules, new operating models are starting to emerge at banks, said Lakshmanan. There are requests for “spot calculations” or snapshots of a bank at any given time. […]

Model Risk 2. Look Beyond the Numbers

What does the near-disaster on London’s Millennium Bridge have to teach us about model risk? “The bridge, inaugurated with great fanfare by the Queen in 2000, filled with people and began to sway so strongly it had to be immediately shut down,” said Ravi Chari, Manager, Americas Risk Practice at the SAS Institute. “When the bridge was modelled during development, the developers did pose the question ‘what is the probability of 10,000 people walking in unison on the bridge?’ And the answer was ‘practically zero’—but that’s exactly what happened on Day One!” Chari was the second of two speakers on […]

Model Risk 1. After the Crisis

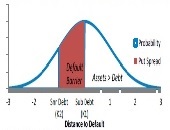

The potential sources of error in constructing a model “is the key point in determining how to handle model risk,” said Suresh Gopalakrishnan, Principal, Business Information Management, at Capgemini Financial Services. He was the first of two speakers on the topic of model risk management (MRM) in the post-financial crisis regulatory regime, and was speaking at a webinar organized by the Global Association of Risk Professionals on April 24, 2014. Model risk is very wide-ranging. “What about inadequacies in models?” he asked. “Do they cover black swan events? What about aggregate risk? Is model risk in fact part of operational […]

Commercial Credit Analytics 2: A Missed Opportunity

Many banks are wasting the loans data they capture, according to David O’Connell, Senior Analyst, Aite Group, a financial services consulting group. This posting summarizes the second half of his webinar organized by the Global Association of Risk Professionals on February 20, 2014. O’Connell contrasted marketing teams with underwriting teams. Marketing teams use predictive analytics to decide which customers are most likely to respond to certain campaigns. They are very forward-thinking in devising the “customer next best action,” he said. O’Connell encouraged the credit and underwriting teams to have a similar outlook—to also make use of predictive analytics to determine “borrower […]

Commercial Credit Analytics 1: Under-utilized Tools

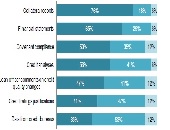

“There is a surprising under-utilization of common tools,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group, during a webinar organized by the Global Association of Risk Professionals on February 20, 2014. He was referring to a survey by Aite Group of about twenty North American commercial loan underwriting professionals (responses as at quarter end Q3 2012). O’Connell characterized the under-utilization as “surprising” because loan underwriting is such an important part of banking. O’Connell was formerly a loan underwriting and loans officer, and was clearly familiar with the details of commercial lending and its role in “Banking […]

Monetary Policy and Treasury Risk Premia: Part 2

After giving an overview (see Part 1), Paul Whelan, of the Imperial College London and formerly the European Central Bank, walked the audience through the mechanics of an award-winning paper on monetary policy at a webinar on January 16, 2014 sponsored by GARP. A shock, by its very nature, is non-routine. Therefore, “a good measure of monetary policy shocks should exclude systematic components,” Whelan said. Another challenge was to “distinguish between quantity of risk versus price of risk channels.” Use of the Taylor rule allowed the researchers to isolate the exogenous dynamics of monetary policy. The trio was able to […]

Monetary Policy and Treasury Risk Premia: Part 1

“Monetary policy makers want to control the long end of the yield curve,” said Paul Whelan at a webinar on January 16, 2014 sponsored by the Global Association of Risk Professionals. Whelan co-authored an article that won the 2013 GARP Award for best paper in financial risk management. “Monetary Policy and Treasury Risk Premia”, by Andrea Buraschi, Andrea Carnelli, and Paul Whelan, provides a quantitative analysis of the effect of monetary policy shocks on future bond returns. Buraschi is at the University of Chicago Booth School of Business and Imperial College London; Carnelli is at Imperial College London; and Paul […]

Eye on Credit Markets. Part 1: Little Beta, Lots of Alpha

“How will the credit markets perform if the Federal Reserve Board chooses to taper over the next year or so?” asked Sivan Mahadevan, Head of U.S. Credit Strategy and Global Credit Derivatives Strategy at Morgan Stanley. He posed this question to members of the Global Association of Risk Professionals on November 21, 2013. Here, “tapering” refers to a gradual lessening of asset purchases. As the first of two speakers in a webinar presentation, Mahadevan summarized the credit markets to date: “little beta, lots of alpha.” Investment grade assets have had a good rally this year. “The higher yields go, the […]

Leveraging Risk Analytics. Part 2

“To drive competitive value, a business must build situational context,” said Tom Kimner, Head of Americas Risk Practice & Global Risk Products at SAS. “And it’s extremely important to take the holistic view.” He was the second of two speakers at a GARP webinar on September 17, 2013 on leveraging risk analytics to drive competitive advantage. To build situational context, Kimner noted the analytics system must provide prediction and data mining, alternative sourcing, and optimization. “Build context for the data as it is used.” The different types of return metrics will help determine what is “best” in relative terms. Kimner […]