Does the average household want to invest in climate-friendly assets? If so, what proportion of assets are earmarked for green investments? What kinds of assets (equity or fixed income) are preferred?

“Green investments are popular, but only about one-third of German households have some kind of green account,” said Monika Piazzesi, Professor of Economics at Stanford University. She was speaking at a webinar titled “Household Climate Finance: Theory and Survey Data on Safe and Risky Green Assets,” held on September 7, 2023, as part of the Virtual Seminar on Climate Economics sponsored by the Federal Reserve Bank of San Francisco (FRBSF).

Her group studied consumer appetite for green investment by analyzing data on German households collected by the Deutsche Bundesbank survey, Household Survey on Consumer Expectations, collected in November 2021 and May 2022. For each round of the survey, approximately 2,000 representative members of the general public responded.

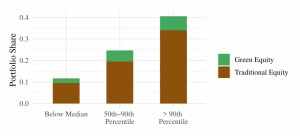

The households with net worth below the median of the sample had smaller portfolios, and, within these portfolios, had a smaller percentage invested in “green” assets. The richest households (90th percentile above median) tended to have the largest proportion of green assets, 11 percent of the aggregate portfolio. These findings are summarized in the graph below.

Why choose green assets over traditional? It seems there may be some social signalling involved. Owning green assets “correlates strongly with other behaviours,” Piazzesi noted. In the dataset she studied, persons who invest in green assets are more likely to be young, female, have higher education, vote for the Green party, and live in the former West Germany.

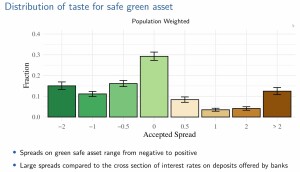

Respondents were asked about what kind of spread they would accept on the rates of return between green assets and traditional assets. If the rates of return were equal, 30 percent of respondents would choose green assets. Sixteen percent of respondents said they would want a spread of at least 0.5 percent more before choosing green assets, … and so on, as the graph below shows.

Risk Appetite for Green Assets

To measure the risk appetite or “taste for risky green asset,” researchers asked the question: “Imagine you have saved part of your earnings and wish to invest this money in an equity fund starting today. Would you rather invest in a traditional equity fund or a sustainable equity fund?” [English translation of the original, in German]

The researchers uncovered “extra motives for green investments that scales with risk,” Piazzesi said. Positive hedging demand for green funds occurs because this will help if the transition to sustainable energy becomes faster. On the other hand, negative hedging demand for green funds occurs if the investor thinks there is a high probability of political backlash.

The economists used a quantitative asset pricing model. Piazzesi described how survey responses (the observables) were mapped to model parameters. The full work-up is reported in a working paper by four authors: Shifrah Aron-Dine, Johannes Beutel, Monika Piazzesi, and Martin Schneider. All co-authors are at Stanford University, with the exception of Johannes Beutel, who works at Deutsche Bundesbank.

“The taste for green [investing] has small aggregate effects,” she said, “and it masks very large effects at the individual level.”

She discussed some counterfactual thought experiments such as, “How much would the outcome differ if there were no desire for green assets?” In that example, they would expect to see a “lower price for green equity because it’s valued less.” (The test proved true.)

Over the time frame of the study, Piazzesi and co-workers found that not just the desire for green assets changed, but also the perception of the market changed.

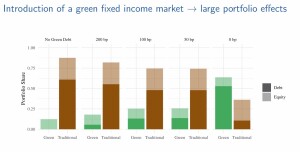

The introduction of a green fixed-income market had large portfolio effects. Comparing two risk-free assets with different returns, sustainable investing opened up a “greenium” (green premium) of 109 basis points, or about 1 percent. “Equity funds can encourage climate-friendly operations.”

Findings

Green investments are popular but currently are mostly of the risky type, such as stocks.

There is significant variation in the desire for green assets. The current relevance of green investing means “a distribution of tastes” that, on net, lowers the price of green assets. In future, she sees a strong desire for green deposits and also green investments.

“Greater awareness dramatically increases green investment,” she concluded. ♠️

The working paper can be found at Monika Piazzesi’s website: https://stanford.edu/~piazzesi/SafeGreenAsset.pdf

The climate tree graphic is from JustETF website at https://www.justetf.com/en/how-to/invest-in-climate-change.html. Permission is pending.