Central Clearing Design

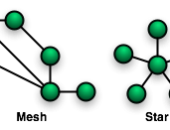

If you had to design a central clearinghouse for transactions in financial markets, what size of guarantees should be offered? And what percentage fees should be charged? “The central clearing modifies the market,” said Andreea Minca, “because the old network structure [of one-to-one] is changing to a new ‘star’ structure.” Minca is Assistant Professor at the School of Operations Research and Information Engineering at Cornell University and was the sole presenter at the December 6, 2016, webinar on systemic risk and central clearing design to members of the Global Association of Risk Professionals (GARP). Under new US legislation, all over-the-counter […]

Chill, Sisyphus

I had agreed to say a “couple of words” about the topic at hand. I was directed into an auditorium where a camera projected my every movement onto a giant screen. A spotlight shone on my frizzled hair and sweat-spotted shirt, and a microphone was thrust into my hand. The other hand, holding the paper with the outline of what I wanted to say, began to tremble… Has this ever happened to you? Has an apparently small meeting ever turned into something much bigger, attracting the attention of five times the number of people you expected? Fortunately I had been […]

Clash of Titans

In the wake of the financial crisis, the two Titans that create accounting standards tried to hammer out agreement over how to account for impairment of loans. These bodies are the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB). “FASB and IASB share the same goal but unfortunately were not able to agree on the same standard,” said Emil Lopez, Director of Risk Measurement at Moody’s Analytics. FASB calls their impairment standard “current expected credit losses” (CECL) whereas IASB deals with impairment and expected losses in their International Financial Reporting Standards as IFRS 9. Lopez was […]

Move Beyond Spreadsheets

Is your firm ready? Financial institutions are seeking answers that will help them plan a roadmap for implementation of the new current expected credit losses (CECL) standard issued by the Financial Accounting Standards Board (FASB). “The runway looks long but firms need to start to prepare now,” said Anna Krayn, Team Lead for Impairment, Capital Planning and Stress Testing at Moody’s Analytics. She was the second of three panellists at the webinar “The Long Road to CECL” sponsored by the Global Association of Risk Professionals on September 8, 2016. “Now is the time to educate, organize and govern, quantify, and […]

Long Road, Many Challenges

Nothing like a financial crisis to show the rough spots in estimation of losses. “Credit losses weren’t being recognized on a timely basis,” and the impairment accounting models were complex and varied widely, according to Kevin Guckian, Partner, National Professional Practice at Ernst &Young. He was the first of three panellists at the webinar “The Long Road to CECL” sponsored by the Global Association of Risk Professionals on September 8, 2016. “FASB’s final standard should accelerate recognition of credit losses,” Guckian noted, referring to the current expected credit losses (CECL) standard newly adopted by the Financial Accounting Standards Board. He […]

Avoid Jekyll and Hyde

Accurate price determination for commodities means that data must be gathered, processed and analyzed. What, then, are current best practices for data management? “Organizations are beginning to recognize their current solutions are no longer meeting current needs,” said Michal Peliwo, Vice President of Business Solutions at ZE PowerGroup. He was the third and final speaker at a webinar on August 24, 2016, sponsored by the Global Association of Risk Professionals, titled “The Price is Right? Strategies for Market Discovery & Optimum Pricing Challenges.” Peliwo described the fragmented world of data management as it exists at most companies. “MS Excel is […]

Optimum Price a Moving Target

How was risk-taking originally priced, and has this changed over time? Centuries ago, mercantile economies used to pool risk for the trading ships that were sent out. Over time, this “big chunk risk” has given way to increasingly more precise ways of determining risk, and is now down to individual financial transactions. “Pricing is the centre of gravity of this operation,” said Robin Bloor, Chief Analyst at The Bloor Group. “For every product theoretically there is an optimum price.” Beginning with this historical comparison, he was the first of three speakers at a webinar on August 24, 2016, sponsored by […]

Pain of Payment for … the First Date

This concludes the interview with Professor Avni Shah regarding consumer behaviour and the connection we feel to the stuff we buy. And, possibly, to the people we buy it for. Click here to read the first half of the interview. Q: Did you look at other aspects of the connection? I said, let’s see how long this effect persists. I got data for the years 2004 to 2013 from an alumni association. What I was interested in is how alums make donations: by cheque versus card. Cheque feels more painful because you have to write out that amount. I wondered […]

Pain of Payment for … Coffee

“Me? Why do I have to pay for the falafels? I barely have two dollars to rub together,” said Morty. Tuesday is the two-for-one special at our local take-out Mediterranean shop. “Take it from me—you’ll enjoy them more!” I said, tapping the article I had just been reading in the New York Times. In a nutshell, it reported on new research in the Journal of Consumer Research that said having some difficulty in payment increased the consumer’s connection with the item purchased. He grabbed the section to read while we wolfed down our falafels. “You’ve gotta interview these people,” he […]

Data Science 2. The Roadmap

“The core concept for data science is hypothesis testing,” said Nima Safaian, team lead for Trading Analytics at Cenovus Energy. The data scientist must identify trends, generate hypotheses, and test, test test. The scientist’s bent toward hypothesis testing should be even stronger than their math skills. Safaian was speaking at the Data Science webinar on August 2, 2016, sponsored by the Global Association of Risk Professionals (GARP). “Attitude is everything,” Safaian said. “Think like a startup. Have an agile mindset,” he urged, referring to the books The Lean Startup by Eric Ries and The Lean Enterprise by Humble, Molesky, and […]