Basel, the Big Picture: Tackling Risk Aggregation & Reporting. Part 1

“It’s a quality piece of work that lays out the road ahead,” said Donna Howe, professor of finance at Brandeis International Business School. She was the first of two speakers at a webinar to discuss the 2013 Basel paper, Principles for Effective Aggregation and Reporting of Risk Data. The webinar was sponsored by the Global Association of Risk Professionals. Besides governance, Howe noted the 14 principles described in the paper expressed four main themes: completeness, accuracy, timeliness, and adaptability. Completeness of risk reporting is necessary, but “it becomes very easy to lose the nuance” when the data are too numerous […]

Exchange-Traded Funds: Beyond Beta?

“An ETF is a structure, not a strategy,” said Som Seif, founder of Claymore Investments, purchased in 2012 by BlackRock. He was addressing an afternoon roundtable on exchange-traded funds at the downtown offices of the CFA Society Toronto on November 28, 2013. ETFs are gaining attention nowadays, he said, because “lower fee investment management is the current trend.” Trained as an engineer, Seif noticed early on in his financial career that “indexing tended to win out,” net of fees. “I don’t believe markets are efficient,” he said, nor does he think that market capitalization is necessarily the best way to […]

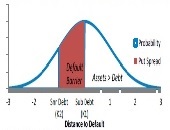

Eye on Credit Markets. Part 2: Spreads Hit Floor

“The central bank stimulus has been significant—what will happen as it’s withdrawn?” asked Seth Rooder, Global Credit Derivatives Product Manager at Bloomberg. He was the second of two speakers to consider the effects of tapering in a GARP webinar presentation on November 21, 2013. A key question is: “when will the Fed taper?” Rooder said not soon, because with unemployment still above 6.5 percent, Vice-Chair of the Fed Janet Yellen will have unwillingness to taper. Currently, the Fed is pumping money into the system by buying $40 billion in mortgage-backed securities and $45 billion in Treasury bills per month. He […]

Eye on Credit Markets. Part 1: Little Beta, Lots of Alpha

“How will the credit markets perform if the Federal Reserve Board chooses to taper over the next year or so?” asked Sivan Mahadevan, Head of U.S. Credit Strategy and Global Credit Derivatives Strategy at Morgan Stanley. He posed this question to members of the Global Association of Risk Professionals on November 21, 2013. Here, “tapering” refers to a gradual lessening of asset purchases. As the first of two speakers in a webinar presentation, Mahadevan summarized the credit markets to date: “little beta, lots of alpha.” Investment grade assets have had a good rally this year. “The higher yields go, the […]

Europe: Is the worst over? Part II.

“Deleveraging takes a long time, and it is painful,” said Philippe Ithurbide, Global Head of Research, Analysis and Strategy at Amundi Asset Management. In the second part of his presentation to the CFA Society Toronto on November 19, 2013, he discussed solutions to European financial difficulties. Deleveraging must be helped along in order to shorten the time and reduce negative socioeconomic impacts. “Never in history have we seen the deleveraging of all the players at the same time.” “Banking credit is faltering everywhere in the euro zone,” said Ithurbide. Euro zone bank credit is still highly fragmented by nation, with […]

Europe: Is the worst over? Part I.

“The US had one financial crisis in 2008, but Europe has had two crises—2008 and 2011,” said Philippe Ithurbide, Global Head of Research, Analysis, and Strategy at Amundi Asset Management. He was addressing members of the CFA Society Toronto that had gathered in the TMX Group Centre in downtown Toronto on the evening of November 19, 2013 to hear an overview of European market trends. The first half of his talk was a comprehensive quantified description of the financial woes of the euro zone, followed by several proposed solutions and investments strategies in the second half. In the quarters since […]

Essential Mathematics for Economics and Business

Jonny Zivku, Product Manager at Maplesoft, gave a tour of the web-based tutoring and assessment product Maple T.A. on November 12, 2013. To highlight its features, Zivku drew on content that was tailored specifically for Essential Mathematics for Economics and Business by Teresa Bradley. This is one of the leading introductory textbooks on mathematics for students of business and economics, and was recently re-issued in its fourth edition by John Wiley & Sons. Each chapter of the book is structured with an overview, explanation, and applications. Students who do the exercises can check their answers against solutions given at the end of […]

Americans Among Us. Part 2.

When it comes to US-Canada cross-border tax planning, a suggested rule of thumb is “to plan as if the US spouse is the spender and the Canadian spouse is the one saving assets,” said Christine Perry, lawyer at Keel Cotrelle LLP, during the second half of a seminar at the CFA Society Toronto offices on October 29, 2013. Perry identified eight common issues in cross-border tax planning that she encounters. Her list began with wills that are drafted in contemplation of “only” Canadian law, “which I see two or three times a month,” and moved on to issues involving gifts, […]

Americans Among Us. Part 1.

“Know your client” is fundamental to managing issues that might arise in tax and estate planning, according to Christine Perry, lawyer at Keel Cotrelle LLP and specialist on cross-border tax and estate planning solutions for high net worth individuals. She led an afternoon seminar titled “Americans Among Us: US Issue Identification” at the CFA Society Toronto downtown offices on October 29, 2013. “Sometimes a client does not even realize he has to make a US tax filing,” said Perry, citing as an example someone born out of wedlock, not in the US, but whose mother is a US citizen. She […]

China: Global Leader, Threat, or Both? Part 2.

“The likelihood of conflict is low but non-negligible” when it comes to China’s perspective on Japan’s re-militarization, said Daniel Wagner, CEO of Country Risk Solutions, during the second half of his Global Association of Risk Professionals webinar on October 22, 2013. After surveying Sino-American relations in Part 1, Wagner guided the audience through an in-depth look at China’s evolving geopolitical position in Asia and Africa. Japanese Prime Minister Shinzo Abe has raised military spending, loosened constitutional constraints on military action, and given a high profile to the Senkaku Islands dispute. Sabre-rattling occurs, but Wagner doubts that China and Japan would […]