As we slide into summer 2022, what are the big factors affecting the markets? Carbon, cargo, Covid. Governments and companies are starting to address the excessive carbon dioxide that is causing climate change. Interruptions of the supply chain, heavily dependent on cargo ships, continue to worsen operational risk. Meanwhile, the global economy is still dealing with the Covid-19 pandemic.

On May 2, 2022, Derek Walter, head of the Institutional Asset Management Committee at the CFA Society Toronto, moderated two panelists during a webinar to discuss the underlying drivers of market changes. “We need to separate the short-term from the long-term effects,” he said.

To identify long-term trends, said Caitlin Walsh, Managing Director at CPP Investment Board, her group aims to understand the driving forces. Based in San Francisco, she conducts research and manages public equity portfolios to invest in long-term structural growth.

She began with a success story. Two years ago, her group drew on “research by psychologists to understand the pandemic behaviour” that was just beginning to emerge, and they correctly predicted high-growth areas. “For example, on-line grocery shopping had a market share of 5 percent before Covid,” she said, “and reached a peak of 30 percent.” Telehealth is experiencing slow, continued growth. The question now is whether these, and related changes in consumer behaviour, will become permanent.

“Our approach begins with three overriding themes that lead to many significant transformative trends for investing,” said Matthew Lipton, Co-Head of Infrastructure Investment Research at Partners Group. He manages a team to develop the thematic and strategic outlook for a multi-billion-dollar private infrastructure portfolio.

Three prominent themes work their way down to industry-specific themes, he said, thereby driving change at the company and asset level. Decarbonization and digitization are the big trends, and the third is “new living,” referring to certain changes in consumer preferences. He identified “smart cities” as one aspect of new living. “We are moving from vehicle-centric to person-centric.”

“We don’t think the world changed, but Covid accelerated some things.” E-commerce is growing, Lipton said, but it requires physical enablers within the supply chains—people and ships and trucks getting the goods to those who ordered them online—and these are critical to the success of e-commerce.

Walsh said that a new theme in individual mobility is that consumers are moving away from shared modes of transit toward electric vehicles (EVs). “The continued penetration of EVs is a big story in the E.U.” However, shortages in the supply chain are affecting the production of EVs.

Looking long-term

Walsh’s group looks at high-level trends in demographics, workforce, and climate change. They track government policy, corporate commitments, and consumer buying trends. “We ask, where does the sentiment come from?” This reveals whether setbacks in adoption are minor—or will alter the trend. For example, “in the long term, EVs will be here, but in the short term, consumers buy whatever is available, even if it’s a non-EV car.”

Lipton said his group wants to identify structural trends even if they are barely visible at this stage. For example, “Hydrogen will become extremely important as a fuel, but we don’t think the technology is there yet.” He described “transformational investing,” which focuses on governance to “make sure a company’s board will transform into what you think the future will hold.”

“Our boards challenge our CEOs,” Lipton said. Partners Group has senior advisors and operating directors with deep experience. “We try to find people who’ve been in the industry for 10, 20, 30 years.”

CPPIB prefers to keep their talent in-house. “Consultants have lower engagement,” Walsh said. “Also, our research is updated on a regular basis, and it’s easier to update” if the same personnel are around.

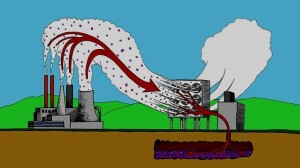

Climate change

Walsh said the trend toward green consumerism is here to stay. Her group is looking into agricultural technology (ag tech). “Alternative proteins—these are a big, overlooked part of decarbonization.” She said the supply chain for battery minerals is convoluted but extremely important because “all net-zero carbon scenarios include electric vehicles.”

Partners Group has been investing in renewable energy technology since 2001, Lipton said. The problem is more than just providing renewable energy; the energy sources need to be reliable and flexible. “In Chile and Colombia, the water supply is not dependable, so hydroelectric power is not reliable.”

Behaviour changes are difficult and that could stymie climate change. “People don’t want to change the way they live,” he said. “They want plastics and air conditioning.”

“There are some ‘hard to abate’ processes, about 20 to 30 percent [of the total footprint] where it will be really hard to remove carbon.” For example, steel production and “processes that operate at a high temperature.” An electric airplane would be a long time coming.

He estimated a trillion dollars must be spent (1 to 2 percent of global GDP) over the next twenty years to meet climate change commitments.

Geopolitical

Walsh said regionalization in supply chains has been apparent for a long time. “High gas prices are due to reliance on supply chains.” A full economic transition is necessary for improved security of supply.

“The history of energy is filled with speed bumps,” Lipton said. Partners Group is helping to build a robust natural gas supply chain in Germany. “We have a ludicrous amount of energy in North America, but Europe is short of energy, and their energy security is threatened.”

Final thoughts

“Autonomous trucking is something we like,” Walsh said. “There’s a strong economic rationale for lowering the cost of driving” and the technology is constantly being improved.

Lipton said that carbon management is certain to be a major area of interest. “People thought decarbonization would start to happen right away, but it takes 3 to 5 years to get projects underway.” To reach net-zero carbon emissions by the target date, countries must vastly improve methods of carbon capture. ♠️