Central Clearing Design

If you had to design a central clearinghouse for transactions in financial markets, what size of guarantees should be offered? And what percentage fees should be charged? “The central clearing modifies the market,” said Andreea Minca, “because the old network structure [of one-to-one] is changing to a new ‘star’ structure.” Minca is Assistant Professor at the School of Operations Research and Information Engineering at Cornell University and was the sole presenter at the December 6, 2016, webinar on systemic risk and central clearing design to members of the Global Association of Risk Professionals (GARP). Under new US legislation, all over-the-counter […]

Mega-Platforms, Mega Risk

There’s a world of difference between innovation and disruption. “Think of innovation as doing more, in the same old way,” said Haydn Shaughnessy, innovation specialist and author of Platform Disruption Wave: How the Platform Economy is Changing the World. He presented a GARP webinar on “The Rise of Mega-Platforms and the Risks to Banking” on May 25, 2016. In the first part of his talk, he described mega-platforms. He referred to the thesis of The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail by Clayton Christensen. This book argues that successful companies get so caught up in meeting […]

The Dawn of the Mega-Platform

Disruption of the financial sector is just on the horizon, says Haydn Shaughnessy, author and innovation specialist. He presented a webinar on “The Rise of Mega-Platforms and the Risks to Banking” to the Global Association of Risk Professionals (GARP) on May 25, 2016. His books include The Elastic Enterprise, Shift, and (most recently) Platform Disruption Wave. “What are the consequences of the disintegration of industry structures?” Shaughnessy asked. Most people see innovation as trying to get more of something that’s desirable, he said, but they might not understand clearly where they are headed. In short, what is the “big picture” […]

Platform of the Future

What will be the ideal modelling platform of future bankers? It will need to contain key functionalities in model execution, scenario management, and a “risk engine” that will deliver answers for multiple horizons at the loan level. Furthermore, it should implement the most advanced modelling suites, reduce the quants’ time to develop models, and contain simulation capabilities for stress testing and beyond. This bold vision of the future was presented by Martim Rocha, Advisory Business Solution Manager at SAS. He was the second of two presenters at the February 25, 2016, webinar offered by the Global Association of Risk Professionals […]

Integrated Data and Modelling

How can today’s bankers prepare for tomorrow’s challenges? Consider the financial models built using available data. Data collection and financial modelling used to be conducted in each different silos of the bank, with credit separate from market, which was separate from treasury and other groups). Then data became “managed” and modelling was moved to “platforms” which did not mix well between the various silos. A few brave souls began to integrate the data management for different groups of the bank. Other brave souls tried to integrate the modelling. This was the phase of integration achieved through batch calculations. Now, the […]

The Latest & Greatest

Although the next round of changes to accounting standards will not come into effect until 2018, alert financial analysts should already be asking companies about how they plan to address them, according to Canada’s top accountant. “Pay attention now, because companies do have the option to adopt” and some, such as Canadian banks, are adopting IFRS 9 early, said Linda Mezon, Chair of the Accounting Standards Board (AcSB). She was speaking at a webinar on January 21, 2016, to members of CFA Society Toronto and CPA Canada on the recent developments in accounting standards and emerging trends impacting financial statements. […]

“Feedback Difficult to Obtain”

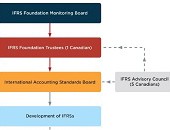

In the financial world, change is a constant. Regulators can barely keep up. Who decides what regulatory changes need to be made? And who can apply the brakes, if a certain type of change is having unintended consequences? Canada’s top accountant briefed the members of the CFA Society Toronto jointly with CPA Canada at a webinar on January 21, 2016. “Feedback is important but difficult to obtain,” said Linda Mezon, FCPA, FCA, who is the Chair of the Accounting Standards Board (AcSB). She summarized how Canadians and the AcSB influence the development of International Financial Reporting Standards. “The Accounting Standards […]

Topology Can Streamline Modelling

How can software systematize and optimize the routine tasks in building financial risk models? “We use topology to inform feature selection, and then we examine a range of models,” said Mukund Ramachandran, Data Scientist at Ayasdi. He was the third of three panellists at the October 27, 2015, webinar on Effective Risk Models Using Machine Intelligence sponsored by the Global Association of Risk Professionals. In the course of evaluating potential models, several statistical tests are applied. “Machine intelligence considers the entire high dimensional space jointly,” he said. Machine learning is capable of applying hundreds of algorithms and different combinations, “but […]

Machine Intelligence + Business Intuition

Given the exponential growth in data complexity, how can you, the risk manager, quickly determine the most salient economic factors to include in calculating a bank’s risk exposure? Nowadays, modelling risk is all about “speed, accuracy, and defensibility,” said Patrick Rogers, Head of Marketing at the software company Ayasdi. Risk models must be developed “in a relatively short time window and must be statistically valid.” Since risk models must be defensible to business owners and industry regulators, and simple to explain, the ordinary “black box” machine learning would fall flat, Rogers said. He was the second of three panellists at […]