“Lending Will Be Marketing Gimmick”

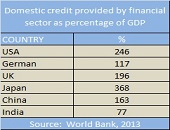

What will be the effect of Basel III on banks in emerging markets? “Commercial banks will become less interested in providing loans,” said Dr. Michael C. S. Wong, the first panellist in a webinar on Banking in Emerging Markets held November 20, 2014, and sponsored by the Global Association of Risk Professionals. He is Associate Professor of Finance at City University of Hong Kong, and Chairman at CTRISKS Rating. Wong summarized the challenges of the new Basel III regulatory regime, with its tougher capitalization and liquidity requirements. A global systemically important bank (G-SIB) will have additional capital and cash-holding requirements, he said, […]

Basel III Standardized: the Holistic Approach

“Banks need technology to help with Basel IIII compliance because moving from Basel I to Basel III is a quantum jump,” said Tom Kimner, Head of Americas Risk Practice at SAS Institute. He was the second of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals to discuss the Basel III Standardized Approach for mid-tier banks. Kimner began by outlining five key issues to Basel III compliance: Data Structure and Validation – The data on credit exposures necessary for capital calculations needs to be cleaned and transformed. “An entire body of work […]

Basel III Standardized: Avoid the Showstopper

“If you can’t comply, it could be a showstopper,” said Henry Fields, Partner at Morrison & Foerster LLP, who was the first of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals. The purpose of the webinar was to discuss the Basel III Standardized Approach for mid-tier banks (assets of over $500 million), and Fields began by giving an overview. The potential “showstopper” would be non-compliance with the new rules for risk weights for assets that are scheduled to come into effect January 1, 2015. “When the Fed issued the [new] […]

Risk Ratings 2. “Hundreds of Spreadsheets”

“There were hundreds of different spreadsheet templates floating around,” said Christopher Hansert, Product Manager at Bosch Software Innovations, and the second of two presenters at a GARP webinar on the impact of new capital rules on risk ratings, held June 24, 2014. He presented a case study of an unnamed US commercial bank. Due to an acquisition during the period of regulatory change, he said that the bank had a “heterogeneous set of platforms, models, and inconsistent ratings. They wanted one robust and centralized” risk rating system. Inconsistencies in the risk rating process increased the likelihood of error, Hansert pointed […]

A Successful Operational Risk Program 2. Purpose

“The purpose of the framework is to provide business value,” said Philippa Girling, Commercial Business Chief Risk Officer at Capital One and author of Operational Risk Management: A Complete Guide to a Successful Operational Risk Framework. She was the second of two presenters at a GARP-sponsored webinar on April 8, 2014 that attracted about 2,000 registrants. “Good governance drives good behaviour,” said Girling, noting that the standards of Basel II have now become the de facto standard. Operational risk is “about anything that can go wrong” that’s not market or credit risk. “People make mistakes, systems fail, policies fail” plus […]

Trading Book Capital: Repercussions of a Revised Framework

“Currently, there’s a large gap between models and the standardized approach. [The members of the Basel Committee] are trying to bring these back into line,” said Patricia Jackson, Head of Financial Regulatory Advice at EY (formerly known as Ernst & Young). She was the second of two speakers at a GARP-sponsored webinar on recently proposed changes to the trading book capital requirements. Strengthening the boundary between the banking book and the trading book “could have a significant impact,” Jackson said, because it will be harder to move positions. The change was made “to reduce arbitrage opportunities for placement with respect […]

Trading Book Capital: A Revised Framework

The proposed changes to trading book capital requirements are “a regulatory trade-off among the objectives of simplicity, risk sensitivity, and comparability,” said Mark Levonian, Managing Director and Global Head at Promontory Financial Group, and the first of two speakers at a webinar sponsored by the Global Association of Risk Professionals held February 11, 2014. Levonian acted as “tour guide” for the Basel Committee’s recently proposed changes to the trading book capital requirements. Highlights of the changes are: the revised standardized approach, more rigorous testing, and replacement of the value at risk (VaR) measurement with expected shortfall. “The perception from the […]

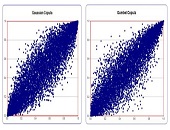

Quant Chalkboard: A New Way to Aggregate

The Gumbel copula is the best way to aggregate losses in economic capital, says Yimin Yang, Director of Model Risk and Capital Management Practice at Protiviti, a global consulting firm. “This copula has asymmetrical behaviour and can model fat tails the best” of the numerous copulas he has tried recently. He was speaking at a GARP webinar on August 20, 2013. Yang began by explaining that a copula was a broad class of mathematical function that could be used to describe the joint distribution function between two or more other functions. Such a joint cumulative distribution function (CDF) must determine […]

Basel III and Beyond: Part 2. Real-Time Counterparty Risk

“Implementing the CVA is a journey with great expectations,” said James Zante, Product Manager for Integrated Market and Credit Risk at IBM Risk Analytics. He was the second of two speakers on the topic of counterparty risk assessment. He presented a real-life case to a GARP webinar audience on June 27, 2013. CVA refers to a new capital charge, the credit valuation adjustment brought in as part of the Basel III regulations. The CVA plays an important role in the optimization of credit capital, said Zante. At one extreme, the trades cleared through the clearinghouse may be considered “risk free,” […]

Basel III and Beyond: Part 1. Optimization with On-Demand Risk Insights

“The capital consumption of credit counterparty risk has become an issue for banks,” said Rita Gnutti, Head of Internal Model Market and Counterparty Risk at Intesa Sanpaolo. She was the first of two speakers addressing the impact of regulatory developments on counterparty risk assessment. She spoke to a webinar audience arranged by the Global Association of Risk Professionals on June 27, 2013. Gnutti first outlined the new Basel III regulatory framework of credit counterparty risk (CCR), then she described its calculation using internal model methodology (IMM), and third she described the computing and back-testing of CCR carried out by her […]