Covid Vaccines

“Be careful what you wish for,” the adage goes, “it might come true.” After a year of an ever-broadening pandemic, vaccines have arrived, and thus begins a new round of planning and negotiating. As the first covid-19 vaccines are rolled out across the world, the magazine the Economist assembled a panel on January 14, 2021, to reflect on the challenges. An audience of thousands tuned in as three seasoned journalists discussed global issues related to vaccine development, the risks of misinformation, and the expected impact of an uneven distribution process of vaccines. The panel moderator was Helen Joyce, executive editor for […]

Ethical Decision Making

Why do well-meaning people engage in unethical behavior? Given that a healthy financial market depends on trust, and that trust is earned through ethical behaviour, ethics are fundamental to ensuring the integrity of finance professionals. A panel of two experts in ethical decision making from the CFA Institute—Jon Stokes, Director, and Paul Johnson, Manager and Special Investigator—spoke live to an audience of about 700 on October 21, 2020 in celebration of Global Ethics Day 2020. A survey of 3500 retail investors showed which industry sectors they ranked as “highly trustworthy.” Medicine was at the top of the list, with 68 […]

ESG disclosures: apples vs oranges

When it comes to environmental, social, and governance (ESG) funds, do you feel like we are still comparing apples with oranges? Isn’t it time for a global voluntary standard? “There’s been an explosion of interest in ESG investing, but the inconsistency in ESG-related disclosures could lead to an erosion of trust in the industry,” said Deborah Kidd, who is a director with the Global Industry Standards (GIPS). She was the first of two panelists who presented a consultation paper on “ESG Disclosure Standards for Investment Products” at a webinar titled “Improving Transparency and Comparability of Investment Products with ESG-related Features” […]

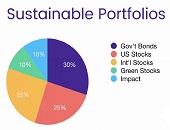

Investing in the greater good

Every day, more investors are converting their portfolios to socially responsible investing (SRI). But does being a socially responsible investor mean you will take a hit on performance? “Over the last five years, responsible investments have done at least as well as the traditional portfolio,” said Tim Nash, a fee-for-service financial planner who spoke at the webinar “Investing in the Greater Good” on August 18, 2020, sponsored by Questrade. Nash is the founder of Good Investing and blogs as The Sustainable Economist. He is also the lead researcher for Ethical Markets Green Transition Scoreboard research report, which details more than […]

Healthy skepticism

Selecting environmental, social, and governance (ESG) funds is a way that ordinary citizens can invest in an ethical way. But what does the increased interest in ESG investing shown by institutional and private wealth clients really mean? Is it paying off? Are we at a watershed moment for structural change in the way investors allocate resources? The move to consider ESG investing came some years ago with scandals such as Enron, and continues with more scandals such as Volkswagen’s Dieselgate and Facebook’s meddlings, said Pedro Matos, a professor of finance at University of Virginia and the author of the CFA […]

Earthquakes kill, and so does bribery

“Bribery and corruption are not victimless crimes,” said Hilary Rosenberg, Managing Director and Global Head of Anti-Bribery & Corruption at Standard Chartered Bank. To drive home the point, she showed a brief video in which the pile of rubble from an earthquake is compared to a house collapsing because corruption allowed an unsafe building to be approved. Furthermore, corruption “can hinder economic progress and destroy people’s trust in their government,” Rosenberg said. She was the first of two speakers at the one-hour webinar “Corruption and Corporate Governance” sponsored by the Global Association of Risk Professionals (GARP) on October 30, 2019. Anti-corruption policy […]

8 Ways to Look at Deforestation Risk

“Forests are the lungs of our land, purifying the air,” wrote Franklin D. Roosevelt. Looking at the economic side, what does the loss of forests mean to global markets? “Deforestation is a risk to the supply chain,” said Gabriel Thoumi, Director Capital Markets at Climate Advisers. “It puts billions of dollars at risk.” He was the first of four presenters at the May 4, 2017, webinar sponsored by the Global Association of Risk Professionals. He began with a summary of the activities of Chain Reaction Research, a group which has been actively assessing the sustainability of the supply chains of […]

Environmental Risk: 5 Lessons Learned

“Deforestation causes severe environmental damage,” said Hilde Jervan, chief advisor of the Council of Ethics of the Government Pension Fund Global (GPFG) of Norway. The scale of deforestation of tropical forests is large, and it is occurring within areas that are ecologically important, thereby aggravating the loss of biodiversity. The GPFG has strong ethical guidelines passed by the Norwegian Parliament in 2004. Jervan discussed these in light of the actual example of tropical deforestation. She was the second of four presenters at the May 4, 2017, webinar on Supply Chain Risk due to Deforestation sponsored by the Global Association of […]

“The Death of the Soul”

Do you long for the good old days? What, exactly, were “the good old days”? Depends on your time horizon. Today’s excerpt comes from page 11 of Economic Thought: A Brief History by Heinz D. Kurz, translated by Jeremiah Riemer (Columbia University Press, 2016). “According to Scholastic economic thought, the answer to the material hardship experienced by large segments of the [medieval European] population was not higher production and economic growth but self-restraint and the repression of needs. “The heart of Scholasticism was the doctrine concerning usury. A core argument was that money is sterile—it cannot “breed offspring.” Another argument […]

Three-Way Damage

Do you remember that cute VW video, “The Force”? The one where the little boy, dressed up as Darth Vader, can’t get a reaction from anyone or anything, even his dog, when he tries his super-powers on them? Then, Dad drives up in his VW Passat and the Vader-wannabe is, magically, able to get the lights to flash. The camera pans to parents looking out the window. Dad gives a conspiratorial grin as he clicks the remote control. On September 18, 2015, world markets were rocked by news that Volkswagen had knowingly falsified its emissions of toxic nitrogen oxides. The […]