Eye on Credit Markets. Part 1: Little Beta, Lots of Alpha

“How will the credit markets perform if the Federal Reserve Board chooses to taper over the next year or so?” asked Sivan Mahadevan, Head of U.S. Credit Strategy and Global Credit Derivatives Strategy at Morgan Stanley. He posed this question to members of the Global Association of Risk Professionals on November 21, 2013. Here, “tapering” refers to a gradual lessening of asset purchases. As the first of two speakers in a webinar presentation, Mahadevan summarized the credit markets to date: “little beta, lots of alpha.” Investment grade assets have had a good rally this year. “The higher yields go, the […]

Essential Mathematics for Economics and Business

Jonny Zivku, Product Manager at Maplesoft, gave a tour of the web-based tutoring and assessment product Maple T.A. on November 12, 2013. To highlight its features, Zivku drew on content that was tailored specifically for Essential Mathematics for Economics and Business by Teresa Bradley. This is one of the leading introductory textbooks on mathematics for students of business and economics, and was recently re-issued in its fourth edition by John Wiley & Sons. Each chapter of the book is structured with an overview, explanation, and applications. Students who do the exercises can check their answers against solutions given at the end of […]

Leveraging Risk Analytics. Part 1

“The new risk management role has a dual responsibility: to the organization, and to achieve business goals. When they contradict each other, the business profitability must come first,” said Boaz Galinson, VP and Head of Credit Risk Modeling and Measurement at Bank Leumi. He was the first of two speakers at a GARP webinar on leveraging risk analytics to drive competitive advantage held September 17, 2013. Galinson referred to the Accenture 2011 Global Risk Management Survey of the 400 biggest corporations (including the 40 biggest banks). Of the respondents, 93 percent said that “sustainability of future profitability” was important or […]

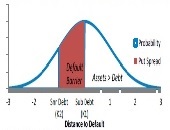

Modeling Sovereign Risk. Part 2: Quantification

“The Bloomberg sovereign risk model starts by dividing countries into two types,” said Rajan Singenellore, “reserve-currency countries and non-reserve currency countries. Everything else depends on that distinction.” Singenellore is Product Manager, Risk & Valuations at Bloomberg and was the second of two speakers to address a GARP webinar audience on September 12, 2013. A reserve-currency country is one whose currency is held in significant quantities by other governments as part of their foreign exchange reserves, such as the US and the Japan. There is a pressing need for quantification in the area of sovereign credit risk, he said, citing as […]

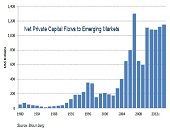

Modeling Sovereign Risk. Part 1: Emerging Markets

“Country-specific factors such as government debt and the sovereign credit rating change slowly but global aggregates such as the risk appetite change quickly, thus leading to confusion the part of observers,” said Michael Rosenberg, Foreign Exchange Consultant, Bloomberg and author of Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination. He was the first of two speakers to address a GARP webinar audience on September 12, 2013. Much of Rosenberg’s talk focused on the sovereign credit risk of emerging markets (EM), because the accelerating flow of net private capital into EM from 1980-2014 has been unprecedented. […]

Celebrity Gossip for the Finance Nerds

I stumbled on a small piece of paradise when I came across Milevsky’s book, The 7 Most Important Equations for Your Retirement: The Fascinating People and Ideas Behind Planning Your Retirement Income. This book is stuffed with anecdotes about the mathematical geniuses who derived the equations that are central to retirement planning. “Getting an equation named after you isn’t easy. Unlike a building, hospital ward or even a business school, money can’t buy you this sort of fame,” Milevsky writes. “You must own a very sharp set of knives.” In my undergrad days in chemistry, I recall the moment it dawned on […]

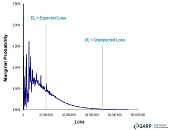

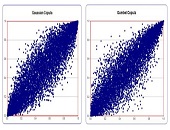

Quant Chalkboard: A New Way to Aggregate

The Gumbel copula is the best way to aggregate losses in economic capital, says Yimin Yang, Director of Model Risk and Capital Management Practice at Protiviti, a global consulting firm. “This copula has asymmetrical behaviour and can model fat tails the best” of the numerous copulas he has tried recently. He was speaking at a GARP webinar on August 20, 2013. Yang began by explaining that a copula was a broad class of mathematical function that could be used to describe the joint distribution function between two or more other functions. Such a joint cumulative distribution function (CDF) must determine […]

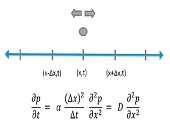

Quant Chalkboard: Data, Models & Concepts

“People are more likely to believe something that comes as data,” said Joe Pimbley, Principal, Maxwell Consulting, “but you shouldn’t necessarily believe the data.” Pimbley, a lead investigator for the examiner appointed by the Lehman Brothers bankruptcy court, addressed financial risk management professionals at a GARP webinar on August 6, 2013. [Ed. Note Click here to read Joe Pimbley – “Why Lehman Brothers Failed When It Did” on Stories.Finance.] Pimbley said that model builders must always look at data with the eyes of a skeptic. With a PhD in physics he is conversant with models devised to predict the “real world” and […]

Hollywood Math

To showcase its mathematics software, a firm usually works through idealized examples from its client base. Sometimes, the firm will consider a real-life problem. The firm seldom turns to the silver screen for inspiration—yet that was the hook that drew in a webinar audience on June 19, 2013. Jonny Zivku, Product Manager at Maplesoft, provided an entertaining tour of Maple software (version 17), as applied to math problems encountered in the movies. Zivku quickly moved from a discussion of the basic math problem (13 X 7 = 28) encountered by Abbott and Costello in the 1941 classic In the Navy […]

Risk Models: From Governance to Validation: Part 3. Examples

“The calculation of the spread on the tranches is quite involved but essentially boils down to dependencies between names,” said Frederic Siboulet, Principal at iEpsilon and the third of three speakers at a GARP webinar on risk models held June 11, 2013. The tranches in structured credit products he referred to were apparently diversified, but in reality not so. Siboulet chose to illustrate the subtle and embedded risk of models with actual structured product examples. In particular, he said that “We must not overlook the importance of the parameters and their interpretation.” The first example involved stressed correlation within a […]