Risk Models From Governance to Validation: Part 2. A Model of Model Management

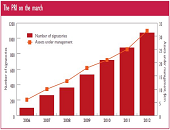

No longer should a firm just use financial models; it should have a “model of model management,” said Donna Howe, Chief Risk Officer at Sovereign Bank. She was the second of three speakers at a June 11, 2013 webinar on risk models organized by the Global Association of Risk Professionals (GARP). Such a “meta-model” would help a firm sort and track models. Howe said that risk models must be understood within the wider frame of compliance and other non-prudential risk. Model parsimony, or Occam’s razor, that was recommended by the first speaker, is good but in the real world “cannot […]

Risk Models From Governance to Validation: Part 1. Don’t Forget the Story

The best practices of risk models–and model building–boil down to one thing: “we can’t forget the story behind it,” said Peter Went, VP, Banking Risk Management Programs at GARP. He was the first of three speakers at a GARP webinar on risk models held June 11, 2013. “There must always be a qualitative story expressible in quantitative terms.” And, vice versa, since any model reduces the complexities of the real world into snippets of mathematical relationships, the opposite must hold true. Went, a trained econometrist, described three main types of models. Fundamental models are based on rules relating basic variables […]

Spotting Signs of Poor Corporate Governance. Part 2: ESG Management

Corporate governance is only one part of an overall phenomenon known as “ESG management,” or how a company handles environmental, social, and corporate governance (ESG) issues. “Research shows that companies that disclose more ESG information are more likely to enjoy a lower cost of capital,” said Max Zehrt, Senior Manager at Sustainalytics. He was addressing a noon-hour seminar of financial analysts and portfolio managers on the subject of corporate governance on May 8, 2013 at the offices of the CFA Society Toronto. His talk was the second part of a two-speaker panel moderated by Toby Heaps of Corporate Knights. Zehrt was […]

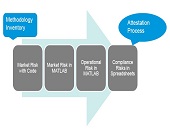

Managing Model Risk: Part 3. Collective Hubris

There are more things in heaven and earth, Horatio, Than are dreamt of in your philosophy. – Wm. Shakespeare, Hamlet, Act 1, Scene 5. “We are building the language in which to discuss model risk,” said Boris Deychman, Director of Model, Market and Operational Risk Management at RBS Citizens Financial Group. He drew an analogy with the world of wine experts, who have developed specific vocabulary to talk about aroma and taste. “They don’t say just: this tastes like wine.” Deychman was the third and final speaker of a panel invited by the Global Association of Risk Professionals to discuss […]

Managing Model Risk: Part 2. The Impact of Basel III

“More consideration must be made for regulatory capital changes that focus on small but potentially devastating risks or risk factors,” said Peter Went, VP, Banking Risk Management Programs at GARP. He was speaking about Basel III and its impact on modelling regulatory capital at a webinar on January 29, 2013, organized by the Global Association of Risk Professionals to discuss model risk management. Went mentioned three developments in the Basel III that directly impact capital models and model risk in regulatory capital determination. First, Basel III introduces a risk-invariant leverage ratio of 3 percent in recognition that models may be […]

Managing Model Risk: Part 1. “Models are Always Wrong”

“Models are always wrong,” said Joe Pimbley, Principal at Maxwell Consulting, via webinar on January 29, 2013. He was the first of a panel of three speakers invited by the Global Association of Risk Professionals to discuss model risk, what it is, and how to assess and validate it after the financial crisis. Models are always wrong, Pimbley clarified, because they are only simplifications. “Wrongness” he defined as some type of error or omission that materially impacts the results as understood by the user. A model can be wrong because the meaning of the result differs from that understood by […]

MATLAB for Excel Users: “Discoverability”

When looking for good data analysis tools, many financial professionals turn first to MS Excel which displays numeric data, contains advanced functions, and can be programmed with Visual Basic. A growing number of professionals are turning to MATLAB which has strengths complementary to ordinary spreadsheets. At a webinar on January 15, 2013, Adam Filion, application engineer at MathWorks, showed approximately three hundred audience members how easily features of MATLAB software adapt themselves to rapid analysis of large datasets. In Excel functions, the input is specified as a cell location and the math is hidden. In MATLAB, the interface has a […]

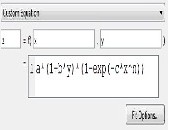

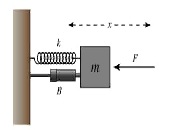

Analytical Tools to Gain Insight and Speed Up Numerical Analysis

“Symbolic computing can be a practical part of the solution to your problem,” said Deepak Ramaswamy, technical marketing manager at Mathworks. On January 8, 2013 he showed about three hundred participants via webinar how they could switch between analytical tools in a Notebook app to numerical analysis of the same problem in the MATLAB interface. He stepped his way through one “classic” and two “real-life” problems: the damped oscillator model; fuel consumption of a rocket-powered car; and kinematics of a double-jointed robot arm. The three problems can be written as systems of Ordinary Differential Equations (ODEs) and this was the […]

Mining Microeconomics Using MATLAB

Modelling the economics of an iron ore mine “is a complex task that can be made more reliable,” said David Willingham to a webinar audience on December 5, 2012. Willingham, an application engineer at Mathworks, was demonstrating how a typical mine’s economics could be modelled using MATLAB and then embedded within an Excel spreadsheet. Developing a mine involves significant capital expenditures and long time frames. Willingham aimed to take the audience through a good model that would take into account the microeconomics of a particular mining company, integrated with the macroeconomic environment, such as interest rates and iron ore prices. […]