Risk Volunteers: Two Profiles

While attending the Toronto chapter of the Global Association of Risk Professionals meetings, we at TextMedic notice a few dedicated volunteers doing everything from handing out name badges to introducing guest speakers. Of course, that’s just the tip of the iceberg—these folks also do a lot of unseen labour such as holding organizational meetings and composing e-mail broadcasts and twisting arms of reticent (and busy) subject matter experts. Thanks to the local chapter, TextMedic has reported in the past on live events about things like pension plan risk, a low volatility equity strategy, and risk data aggregation and reporting. Since National […]

A Successful Operational Risk Program 2. Purpose

“The purpose of the framework is to provide business value,” said Philippa Girling, Commercial Business Chief Risk Officer at Capital One and author of Operational Risk Management: A Complete Guide to a Successful Operational Risk Framework. She was the second of two presenters at a GARP-sponsored webinar on April 8, 2014 that attracted about 2,000 registrants. “Good governance drives good behaviour,” said Girling, noting that the standards of Basel II have now become the de facto standard. Operational risk is “about anything that can go wrong” that’s not market or credit risk. “People make mistakes, systems fail, policies fail” plus […]

A Successful Operational Risk Program 1. Framework

“A clear strategic direction of your company should help formulate clear business objectives, understood by all stakeholders, including employees,” said Brenda Boultwood, SVP, Industry Solutions at MetricStream. An operational risk may be seen as something, together with credit or market risks, which impedes “achieving those business objectives” and includes IT risk, HR risk, and reputation risk. MetricStream is a provider of Governance, Risk, Compliance (GRC) management software and consulting. Boultwood was the first of two presenters at a GARP-sponsored webinar on April 8, 2014 that attracted about 2,000 registrants. Operational risk has evolved from conceptual to strategic, and is now […]

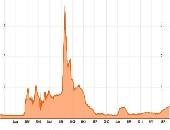

Trading Book Capital: Repercussions of a Revised Framework

“Currently, there’s a large gap between models and the standardized approach. [The members of the Basel Committee] are trying to bring these back into line,” said Patricia Jackson, Head of Financial Regulatory Advice at EY (formerly known as Ernst & Young). She was the second of two speakers at a GARP-sponsored webinar on recently proposed changes to the trading book capital requirements. Strengthening the boundary between the banking book and the trading book “could have a significant impact,” Jackson said, because it will be harder to move positions. The change was made “to reduce arbitrage opportunities for placement with respect […]

Basel, the Big Picture: Tackling Risk Aggregation & Reporting. Part 1

“It’s a quality piece of work that lays out the road ahead,” said Donna Howe, professor of finance at Brandeis International Business School. She was the first of two speakers at a webinar to discuss the 2013 Basel paper, Principles for Effective Aggregation and Reporting of Risk Data. The webinar was sponsored by the Global Association of Risk Professionals. Besides governance, Howe noted the 14 principles described in the paper expressed four main themes: completeness, accuracy, timeliness, and adaptability. Completeness of risk reporting is necessary, but “it becomes very easy to lose the nuance” when the data are too numerous […]

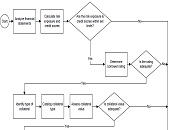

Credit Workflow Optimization: A Practical Approach

“How can an institution practically approach credit workflow when it might not be streamlined? How can we optimize existing processes?” These questions were posed by Justin Huhn, Credit Assessment & Origination Practice Leader at Moody’s Analytics Enterprise during a webinar arranged by the Global Association of Risk Professionals on September 24, 2013. Huhn noted that, as of Q1 2013, there were over seven thousand insured commercial banks and savings institutions in the US excluding foreign branches. These financial institutions tend to develop silos of expertise. Workflow optimization is of pressing concern to many. In 2008 the American Bankers Association estimated […]

Risk Data Aggregation & Risk Reporting. Part 2

“Not everything that can be counted counts,” said Mike Donovan, VP, Strategic Risk Analytics & Credit Portfolio Management at Canadian Imperial Bank of Commerce (CIBC). He was the second speaker to address the September 19, 2013 evening meeting of the Toronto chapter of GARP regarding the set of Principles for Effective Risk Data Aggregation & Risk Reporting released by the Basel Committee in January 2013. CIBC, like other Canadian banks, is adapting to the heightened risk management data requirements and building the foundation for future sustainable growth. Donovan used the opening quote by Einstein to remind the audience that big […]

Risk Data Aggregation & Risk Reporting. Part 1

During the throes of the last financial crisis, banks and regulators alike “struggled” to get good quality information. “The infrastructure was not there,” said James Dennison, CFA, Managing Director, Operational Risk Division, Office of the Superintendent of Financial Institutions (OSFI). To enhance banks’ risk management infrastructure, the Basel Committee on Banking Supervision (BCBS) released a set of Principles for Effective Risk Data Aggregation & Risk Reporting in January 2013. Dennison was first to speak on the evening of September 19, 2013 at the Toronto chapter meeting of the Global Association of Risk Professionals (GARP). It was convened at First Canadian Place to allow […]

Basel III and Beyond: Capital Management and Funding Strategies

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]

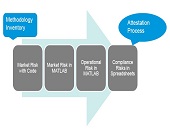

Risk Models From Governance to Validation: Part 2. A Model of Model Management

No longer should a firm just use financial models; it should have a “model of model management,” said Donna Howe, Chief Risk Officer at Sovereign Bank. She was the second of three speakers at a June 11, 2013 webinar on risk models organized by the Global Association of Risk Professionals (GARP). Such a “meta-model” would help a firm sort and track models. Howe said that risk models must be understood within the wider frame of compliance and other non-prudential risk. Model parsimony, or Occam’s razor, that was recommended by the first speaker, is good but in the real world “cannot […]