Geopolitical Risks

Many conflicts and potential conflicts disturb various parts of the world in the post-pandemic era. For those who must manage various sources of risk in a portfolio, what are the biggest threats on the horizon? Is there a common thread among several sources of conflict? The Global Association of Risk Professionals (GARP) provides a series of podcasts featuring specialists discussing their area of risk and we at TextMedic enjoy listening in. This is the first podcast we have summarized in our blog, and for starters we delve into country risk. On April 14, 2024, Daniel Wagner, CEO of Country Risk […]

California Perspective

Imagine feeling shut out from important decisions in your community. Imagine feeling you were always the last choice when it came to hiring for the good jobs. If social studies showed this was always due to systemic bias, wouldn’t you want to work for change—if not for yourself, at least for the generation to come? This is the motivation behind the movement for diversity, equity, and inclusion (DEI). What are the fundamental principles to accelerate change around DEI? Can financial institutions adapt to DEI—and can their regulatory body, CFA Institute, lead the way? To showcase thriving financial institutions that have […]

Green Stocks vs. Brown

Comparing the stock prices of climate-friendly (“green”) companies versus non-climate-friendly (“brown”) companies, which type will give better performance? Has this prediction been changing over the past decade—and why? And what are the recent pressures? On March 23, 2023, Michael Bauer, professor of economics at the University of Hamburg, delivered a webinar on green vs. brown stocks as part of the series of talks sponsored by the Federal Reserve Bank of San Francisco (FRBSF), titled the Virtual Seminar on Climate Economics. He reported results from a recent paper co-authored with three other economists appearing in the Journal of Climate Finance. Bauer […]

E-Growth in Emerging Markets

What is happening in emerging markets? Are there areas where an informed investor can make a profit? What are the pitfalls to avoid? On November 22, 2022, the CFA Society of Toronto hosted a virtual webinar, “Rethinking Emerging Markets: The Case for Growth & How to Capture It.” The speaker was Kevin T. Carter, the founder and Chief Investment Officer of EMQQ Global. Carter began by providing his background. “I pray toward Omaha,” he quipped, because he considers himself an active “value” investor first and foremost, along the lines of “the oracle of Omaha,” Warren Buffett. Carter has collaborated with […]

But What About Inflation?

Now that the worst of the Covid pandemic appears to be over for North America, inflation has kicked in and investors everywhere are on guard. Is the inflationary trend here for the long term? What, really, lies at the root of this particular instance of inflation? Moreover, what is the best hedge against inflation? On April 4, 2022, James Montier, a member of the Asset Allocation Committee of the CFA Society of Toronto, gave a one-hour webinar on “Hedging Inflationary Risk.” He is the author of three market-leading books: Behavioral Finance: Insights into Irrational Minds and Markets, Behavioral Investing: A […]

Six Technologies To Ponder

We live in a time of great challenges yet great innovation. Do you feel overwhelmed with the constant proclamations about what problems need solving most urgently, and what technologies are most effective? Do you seek to invest in new technology that has unrealized potential? On March 17, 2022, Alok Jha, science editor for the Economist, engaged two of his colleagues in a few lightning rounds of “Tell Us About Technology.” The colleagues were Slavea Chankova, healthcare correspondent, and Tom Standage, deputy editor. The three of them gave brief speeches meant to summarize a selected technology and its significance to current […]

“Confront Their Reluctance”

“We believe women need to confront their reluctance to consider a leadership role and work actively to counter it with a more positive response.” This clarion call is issued by two top leaders in the academic and corporate world. Indira Samarasekera was the first woman president of the University of Alberta, and a director of Magna International, TC Energy, and Stelco. Martha Piper was the first woman president of the University of British Columbia, and a director of the Bank of Montreal, Shoppers Drug Mart, and TransAlta Corporation. Although neither was born in Canada, both are officers of the Order […]

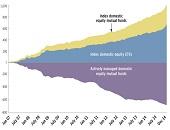

The future of active management

“Active portfolio management is futile,” say some who watch the progression of the financial industry. “Active managers only randomly outperform the stock market as a whole.” Is this true, or have the rumours of its demise been greatly exaggerated? On June 10, 2021, Philip Young, CFA, welcomed a webinar audience on behalf of the CFA Society of Toronto to consider this very question as they listened to Ronald Kahn, Managing Director, and Global Head of Systematic Equity Research at Blackrock, the world’s largest asset manager. He recently co-authored the book Advances in Active Portfolio Management: New Developments in Quantitative Investing. […]

Death of Fundamental Analysis?

Have you been following the market frenzy around stocks for GameStop, AMC and Bed Bath & Beyond? Or the news on Wall Street Bets and Robinhood? How disruptive are these events for traditional valuation methods? What new factors must be considered when investing and allocating capital? Recent shifts in market dynamics have altered the perception of capital markets in meaningful ways. On April 8, 2021, the Corporate Finance Committee of the CFA Society of Toronto convened a panel of experts to discuss the reasons market valuations are so out of synch with fundamental analysis. Moderator Stephen Foerster, Professor of Finance […]