Stressed Interest Rates: Battle of the Models

For generating shocked interest rate curves, such as a sudden economic stress might engender, “a three-factor parameterization solves many problems—but issues remain,” said Alexander Bogin, Senior Economist at the Federal Housing Finance Agency, and the second presenter at a webinar on modelling interest rate shocks held October 28, 2014, and sponsored by the Global Association of Risk Professionals. To develop an improved yield curve approximation, Bogin showed three variants of non-linear Laguerre functions of time to maturity. These were the Nelson-Siegel model (which has 3 factors); the Svensson model (4 factors); and the Björk-Christensen model (5 factors). Over a two-year […]

Correlation Risk

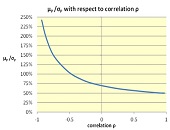

“Before we argue about correlation, we must first agree on which interpretation we are talking about,” said Gunter Meissner, President of Derivatives Software, Founder and CEO of Cassandra Capital Management, and Adjunct Professor of Mathematical Finance at NYU-Courant. He was sole presenter at a webinar on October 21, 2014, sponsored by GARP. Meissner cited three different interpretations commonly used for correlation risk. “In trading practice, it can mean similar movement in time. Or it can be narrowly defined,” he said, “to only refer to the linear Pearson definition.” Third, it can be used in the broader sense of any type […]

Basel III Standardized: the Holistic Approach

“Banks need technology to help with Basel IIII compliance because moving from Basel I to Basel III is a quantum jump,” said Tom Kimner, Head of Americas Risk Practice at SAS Institute. He was the second of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals to discuss the Basel III Standardized Approach for mid-tier banks. Kimner began by outlining five key issues to Basel III compliance: Data Structure and Validation – The data on credit exposures necessary for capital calculations needs to be cleaned and transformed. “An entire body of work […]

DFAST 2. Challenges of Modeling Credit Risk

There are multiple challenges to private firm commercial & industrial (C&I) risk management, according to Mehna Raissi, Director, Enterprise Risk Solutions at Moody’s Analytics. She was the second of two speakers at a GARP-sponsored webinar on September 9, 2014, to address the Dodd-Frank Act Stress Test (DFAST). Successful risk management depends on three things: the potential for error within standardized processes; ongoing monitoring of counterparty credit risk; and the efficacy of credit risk models. A very big challenge is data quality and availability. “What are the types of variables and factors needed?” Raissi asked. “How can we take into consideration […]

Tracking the Elusive Black Swan

Enterprise risk management (ERM) requires a “robust framework design and collaborative approach to capture a black swan event before its occurrence,” said Brenda Boultwood, Senior Vice President of Industry Solutions at MetricStream. She was the second of two speakers at the GARP-sponsored webinar on Black Swans and Reputational Risk held on August 26, 2014. Black swan events are “close to impossible to estimate impact and likelihood,” such as the Japan 2011 tsunami, or Hurricane Katrina. The complexity of these types of risk “requires that we focus on what is most important” in strategic risk management, said Boultwood, naming four principal areas: […]

Clickable Calculus

When finding a definite integral, do you spend an inordinate amount of time in the step-by-step algebra? Let’s say you are integrating over a probability of default function that has been fitted to real-life data (a non-normal curve) and you want to understand step-size dependence. Or perhaps you are a beginning student of mathematical finance, reviewing the fundamentals of integration, and you just wish there was a faster way to change functions and spit out a graph. “Integration is a summative process, and the applications that show this can become a time-sink,” said Robert Lopez, Emeritus Professor of Mathematics at […]

Risk Ratings 2. “Hundreds of Spreadsheets”

“There were hundreds of different spreadsheet templates floating around,” said Christopher Hansert, Product Manager at Bosch Software Innovations, and the second of two presenters at a GARP webinar on the impact of new capital rules on risk ratings, held June 24, 2014. He presented a case study of an unnamed US commercial bank. Due to an acquisition during the period of regulatory change, he said that the bank had a “heterogeneous set of platforms, models, and inconsistent ratings. They wanted one robust and centralized” risk rating system. Inconsistencies in the risk rating process increased the likelihood of error, Hansert pointed […]

Model Risk 2. Look Beyond the Numbers

What does the near-disaster on London’s Millennium Bridge have to teach us about model risk? “The bridge, inaugurated with great fanfare by the Queen in 2000, filled with people and began to sway so strongly it had to be immediately shut down,” said Ravi Chari, Manager, Americas Risk Practice at the SAS Institute. “When the bridge was modelled during development, the developers did pose the question ‘what is the probability of 10,000 people walking in unison on the bridge?’ And the answer was ‘practically zero’—but that’s exactly what happened on Day One!” Chari was the second of two speakers on […]

Model Risk 1. After the Crisis

The potential sources of error in constructing a model “is the key point in determining how to handle model risk,” said Suresh Gopalakrishnan, Principal, Business Information Management, at Capgemini Financial Services. He was the first of two speakers on the topic of model risk management (MRM) in the post-financial crisis regulatory regime, and was speaking at a webinar organized by the Global Association of Risk Professionals on April 24, 2014. Model risk is very wide-ranging. “What about inadequacies in models?” he asked. “Do they cover black swan events? What about aggregate risk? Is model risk in fact part of operational […]