Death of Fundamental Analysis?

Have you been following the market frenzy around stocks for GameStop, AMC and Bed Bath & Beyond? Or the news on Wall Street Bets and Robinhood? How disruptive are these events for traditional valuation methods? What new factors must be considered when investing and allocating capital? Recent shifts in market dynamics have altered the perception of capital markets in meaningful ways. On April 8, 2021, the Corporate Finance Committee of the CFA Society of Toronto convened a panel of experts to discuss the reasons market valuations are so out of synch with fundamental analysis. Moderator Stephen Foerster, Professor of Finance […]

The Achilles Heel of Banking

After last decade’s financial crisis, regulators introduced several new measures to reduce systemic risk in the financial system. How are the new safeguards working? What are the implications for future balance sheet structure? The CFA Society Toronto convened a panel of three experts on November 25, 2020, to discuss the new regulatory capital and liquidity frameworks and how they are reshaping the way Canadian banks approach the market. The webinar, including a Q&A session, was moderated by Nigel D’Souza, Investment Analyst, Veritas Investment Research. “There’s no doubt the financial crisis changed balance sheets,” said Bruce Choy, Managing Director (Former Risk […]

Transforming Healthcare

Great strides have been made in medical treatments, pharmaceuticals and drug therapies, and patient recordkeeping – many of them by for-profit companies. How has the recent advent of Covid-19 shaped these developments? Last week, Pfizer was the first to announce a Covid-19 vaccine candidate. What new financial opportunities await? Three panellists convened on November 17, 2020, to discuss the transformation of healthcare, in a webinar sponsored by the Canadian Association of Alternative Strategies & Assets (CAASA). CAASA is a trade association representing alternative investment managers, service providers, and investors. The panel was moderated by Dr. Ted Witek, Health Care Advisor […]

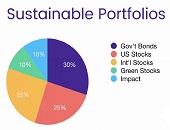

Investing in the greater good

Every day, more investors are converting their portfolios to socially responsible investing (SRI). But does being a socially responsible investor mean you will take a hit on performance? “Over the last five years, responsible investments have done at least as well as the traditional portfolio,” said Tim Nash, a fee-for-service financial planner who spoke at the webinar “Investing in the Greater Good” on August 18, 2020, sponsored by Questrade. Nash is the founder of Good Investing and blogs as The Sustainable Economist. He is also the lead researcher for Ethical Markets Green Transition Scoreboard research report, which details more than […]

Healthy skepticism

Selecting environmental, social, and governance (ESG) funds is a way that ordinary citizens can invest in an ethical way. But what does the increased interest in ESG investing shown by institutional and private wealth clients really mean? Is it paying off? Are we at a watershed moment for structural change in the way investors allocate resources? The move to consider ESG investing came some years ago with scandals such as Enron, and continues with more scandals such as Volkswagen’s Dieselgate and Facebook’s meddlings, said Pedro Matos, a professor of finance at University of Virginia and the author of the CFA […]

Origins of Canadian Banking

The financial crisis of 2007-2008 triggered a worldwide recession. The American and European banking systems experienced massive losses, takeovers, and taxpayer-funded bailouts. Lehman Brothers, Northern Rock, European debt crisis, … and the after-effects are still being felt. Canada’s banking system did have some shaky moments, as a recently published analysis of its asset-backed commercial paper (ABCP) predicament showed. On the whole, however, Canada’s banks withstood the financial crisis relatively well and the financial system maintained its liquidity, solvency, and profitability. The history of the divergence in the Canadian and American banking systems is recounted in a new book. From […]

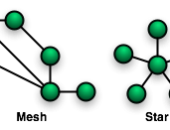

Central Clearing Design

If you had to design a central clearinghouse for transactions in financial markets, what size of guarantees should be offered? And what percentage fees should be charged? “The central clearing modifies the market,” said Andreea Minca, “because the old network structure [of one-to-one] is changing to a new ‘star’ structure.” Minca is Assistant Professor at the School of Operations Research and Information Engineering at Cornell University and was the sole presenter at the December 6, 2016, webinar on systemic risk and central clearing design to members of the Global Association of Risk Professionals (GARP). Under new US legislation, all over-the-counter […]

Stress Testing Mortgages. Part 2

The team of Scott L. Smith, Jesse Weiher, and Debra Fuller at the Federal Housing Finance Agency (FHFA) use specialized financial models to estimate potential losses. They carried out empirical tests of countercyclical shocks using four different models of mortgage credit risk. This posting continues a February 4, 2015, presentation by Scott L. Smith to an audience of financial risk managers at Global Association of Risk Professionals (GARP). Two models were devised at FHFA, and two are commercially available credit models: one, called Black Knight (formerly LPS-AA), and the other called ADCO Loan Dynamics. The estimated losses were converted to a capital […]

Stress Testing Mortgages. Part 1

“One needs to be careful and not over-reliant on any one model,” said Scott L. Smith, Associate Director for Capital Policy at the Federal Housing Finance Agency (FHFA). He was referring to the financial models used by major financial institutions to estimate potential losses. On February 4, 2015, he was presenting a GARP-sponsored webinar on countercyclical stress tests to set capital requirements. Smith explained how credit risk is measured for mortgages, and described a way to embed stress testing that uses countercyclical concepts. He and colleague Jesse Weiher, Senior Economist at FHFA, performed dynamic stress testing that was adjusted to […]

Public vs Private Banks in India and China

“Public sector banks perform worse than private banks In India whereas there is no significant performance difference for the two sectors in China,” said Dr. Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He gave an overview of operational performance and credit risk trends in Banking in Emerging Markets, and was the third of three webinar panellists on November 20, 2014, organized by the Global Association of Risk Professionals. For both countries, Singenellore compared government-owned banks with private sector banks. The terminology is different: India has public sector undertakings (PSU) banks whereas China has state-owned […]