WTO: The Jabs and the Jab-Nots

As the covid-19 vaccines continue to be rolled out across the world, and as trade disputes continue to fester, Ngozi Okonjo-Iweala has her work cut out for her as the new director-general of the World Trade Organisation (WTO). With many years’ experience in politics, economics, and vaccine production, she already has a deep understanding of the issues. On June 29, 2021, she spoke with Zanny Minton Beddoes, editor-in-chief of the magazine the Economist, about ending the covid-19 pandemic and the future of globalization. Ngozi described herself as a “trade outsider” when she first began at the World Bank, “which has […]

From Ideas to Action

Climate change will reshape how financial organizations and investors think about climate-related events. But how will we deal with climate change risk? How will financial organizations respond to increasing demands for transparency, measurement, and action? On February 2, 2021, the Institutional Asset Management Committee of the CFA Society of Toronto convened a webinar with three seasoned experts who discussed how best to move into a world of green initiatives. The session was opened by Brandon Gill, Senior Portfolio Manager, Capital Markets Group, External Public Investments and Credit at OPTrust, the pension trust fund of the Ontario Public Service Employees Union. […]

Climate Risk Survey

Investors continue to ask for more investment strategies that target environment and sustainability. When it comes to capability to manage financial risks due to climate change, how far along are firms in addressing the issues? The second annual global survey of climate risk management at financial firms, sponsored by the Global Association of Risk Professionals (GARP), was presented in a webinar on September 22, 2020. The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP. Paisley began by taking a quick poll of the audience, chiefly GARP members. “Why are you interested in the […]

Healthy skepticism

Selecting environmental, social, and governance (ESG) funds is a way that ordinary citizens can invest in an ethical way. But what does the increased interest in ESG investing shown by institutional and private wealth clients really mean? Is it paying off? Are we at a watershed moment for structural change in the way investors allocate resources? The move to consider ESG investing came some years ago with scandals such as Enron, and continues with more scandals such as Volkswagen’s Dieselgate and Facebook’s meddlings, said Pedro Matos, a professor of finance at University of Virginia and the author of the CFA […]

Inside Story, South America

How are different parts of the world reacting to the Covid-19 Pandemic, and how does that affect those who must analyze and report on global geopolitical risk? The magazine The Economist presented a webinar on May 28, 2020, titled “Inside Story: Reporting on the Covid-19 Pandemic Around the World.” Helen Joyce, executive editor for events at The Economist, interviewed two outstanding foreign correspondents. This is part two of a two-part summary. The second panellist was Sarah Maslin, foreign correspondent for The Economist, South America. She spoke from her home in São Paulo, which is decorated with scarves from soccer teams […]

Top 5 Trends in Risk Management

The champagne has been drunk, and the New Year has been rung in. What trends are predicted in risk management as we welcome the new decade? “In 2020, we’ll likely see significant changes in risk models, processes and functions,” predicts Brenda Boultwood, Risk Advisory Partner at Deloitte. As a senior expert in risk culture and corporate governance, she published an article online January 10, 2020, for the Global Association of Risk Professionals (GARP). We present the highlights and a link to the full article below. The three lines of defense business model, as we know it, will end This is actually […]

From brown energy to green

How will climate change affect the financial sector and the broader economy? What policy responses will mitigate climate change risks? Recently, the US Federal Reserve Bank (FRB) sponsored the first conference dedicated to exploring the economic and financial risks associated with climate change. “Climate change will have sweeping effects on our economy and financial system,” says the report summarizing the main themes of the conference. The report, released on December 16, 2019, was co-authored by Galina B. Hale, Òscar Jordà, and Glenn D. Rudebusch. Hale is a research advisor and Jordà and Rudebusch are both senior policy advisors at the Federal […]

A Good Start…

Financial risks due to climate change are receiving more attention of late, particularly for investors and regulators, but how far along are firms in addressing the issues? A report on climate risk management at financial firms tabled on June 28, 2019, sponsored by the Global Association of Risk Professionals (GARP), answers the question with its subtitle: “A Good Start, But More Work to Do.” The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP. “Our sample covered 20 banks and seven other financial institutions … from across the globe. These firms have a global […]

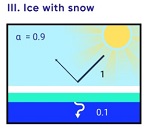

Winds of Change

“Will the greater intensity of climate change expected in Canada produce a greater impact on Canadian financial institutions, and firms that hold a greater proportion of exposure to Canada in its portfolio?” This was the question posed by Robert Thomas, risk consultant to the non-profit organization Ontario Conservation Now as part of a round table held at the Toronto Public Library on April 18, 2019. A report[1] tabled earlier this month by Environment Canada says that climate change will have a greater effect on Canada than on most countries. The report, Canada’s Changing Climate Report 2019 (CCCR2019), looked at observed […]

8 Ways to Look at Deforestation Risk

“Forests are the lungs of our land, purifying the air,” wrote Franklin D. Roosevelt. Looking at the economic side, what does the loss of forests mean to global markets? “Deforestation is a risk to the supply chain,” said Gabriel Thoumi, Director Capital Markets at Climate Advisers. “It puts billions of dollars at risk.” He was the first of four presenters at the May 4, 2017, webinar sponsored by the Global Association of Risk Professionals. He began with a summary of the activities of Chain Reaction Research, a group which has been actively assessing the sustainability of the supply chains of […]