Tailoring Risk Model to Investment Strategy

Due to the growing complexity of measuring financial risk, “risk has become a patchwork” of different models, said Phil Jacob, Senior Director at Axioma Risk Research. He was the sole presenter in a webinar about tailoring the right risk model to your investment strategy held on March 4, 2015, and sponsored by the Global Association of Risk Professionals (GARP). Jacob identified four inherent challenges. “There are operational issues stemming from existing rigid approaches,” leading to “difficulty in aggregating risk.” There is a lack of consistency in modeling portfolios, which can run the gamut from very simple proxies all the way […]

Stress Testing Mortgages. Part 2

The team of Scott L. Smith, Jesse Weiher, and Debra Fuller at the Federal Housing Finance Agency (FHFA) use specialized financial models to estimate potential losses. They carried out empirical tests of countercyclical shocks using four different models of mortgage credit risk. This posting continues a February 4, 2015, presentation by Scott L. Smith to an audience of financial risk managers at Global Association of Risk Professionals (GARP). Two models were devised at FHFA, and two are commercially available credit models: one, called Black Knight (formerly LPS-AA), and the other called ADCO Loan Dynamics. The estimated losses were converted to a capital […]

Stress Testing Mortgages. Part 1

“One needs to be careful and not over-reliant on any one model,” said Scott L. Smith, Associate Director for Capital Policy at the Federal Housing Finance Agency (FHFA). He was referring to the financial models used by major financial institutions to estimate potential losses. On February 4, 2015, he was presenting a GARP-sponsored webinar on countercyclical stress tests to set capital requirements. Smith explained how credit risk is measured for mortgages, and described a way to embed stress testing that uses countercyclical concepts. He and colleague Jesse Weiher, Senior Economist at FHFA, performed dynamic stress testing that was adjusted to […]

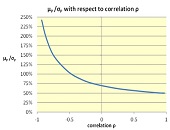

Correlation Risk

“Before we argue about correlation, we must first agree on which interpretation we are talking about,” said Gunter Meissner, President of Derivatives Software, Founder and CEO of Cassandra Capital Management, and Adjunct Professor of Mathematical Finance at NYU-Courant. He was sole presenter at a webinar on October 21, 2014, sponsored by GARP. Meissner cited three different interpretations commonly used for correlation risk. “In trading practice, it can mean similar movement in time. Or it can be narrowly defined,” he said, “to only refer to the linear Pearson definition.” Third, it can be used in the broader sense of any type […]

Clickable Calculus

When finding a definite integral, do you spend an inordinate amount of time in the step-by-step algebra? Let’s say you are integrating over a probability of default function that has been fitted to real-life data (a non-normal curve) and you want to understand step-size dependence. Or perhaps you are a beginning student of mathematical finance, reviewing the fundamentals of integration, and you just wish there was a faster way to change functions and spit out a graph. “Integration is a summative process, and the applications that show this can become a time-sink,” said Robert Lopez, Emeritus Professor of Mathematics at […]

Interview with William Bernstein: The Paradox of Wealth

I could hear the laughter from down the hall. “Cheeseburger,” cried Morty. Cheeseburger? I saw he was holding a back issue of the Financial Analysts Journal. (It’s no secret that we fall behind on our reading here during the busy months.) “You’ve gotta interview this guy,” declared Morty. “Anyone who can work the word ‘cheeseburger’ into the pages of this esteemed journal… well… he likely has something interesting to say.” William Bernstein did indeed have some very interesting things to say. The interview below is the vegan-friendly edition, though; if you want to see ‘cheeseburger’ in print you’ll have to […]

Counterparty Credit Risk 2. The Good, the Bad, the Ugly, and the Unseen

“Data and its accuracy are key to making this work,” said Robert Scanlon, referring to counterparty credit risk. Scanlon is the former Group Chief Credit Officer of Standard Chartered Bank and current Principal, Scanlon Associates. As the second of three speakers at a GARP webinar on counterparty risk held on May 20, 2014, Scanlon spoke from years of experience with risk practices. First, the good part of calculating counterparty credit risk. Scanlon said there is plenty of data already, especially for consumer/retail transactions. “You can start with a steady state assumption and get more data as time goes on. Ask […]

Monetary Policy and Treasury Risk Premia: Part 2

After giving an overview (see Part 1), Paul Whelan, of the Imperial College London and formerly the European Central Bank, walked the audience through the mechanics of an award-winning paper on monetary policy at a webinar on January 16, 2014 sponsored by GARP. A shock, by its very nature, is non-routine. Therefore, “a good measure of monetary policy shocks should exclude systematic components,” Whelan said. Another challenge was to “distinguish between quantity of risk versus price of risk channels.” Use of the Taylor rule allowed the researchers to isolate the exogenous dynamics of monetary policy. The trio was able to […]

Monetary Policy and Treasury Risk Premia: Part 1

“Monetary policy makers want to control the long end of the yield curve,” said Paul Whelan at a webinar on January 16, 2014 sponsored by the Global Association of Risk Professionals. Whelan co-authored an article that won the 2013 GARP Award for best paper in financial risk management. “Monetary Policy and Treasury Risk Premia”, by Andrea Buraschi, Andrea Carnelli, and Paul Whelan, provides a quantitative analysis of the effect of monetary policy shocks on future bond returns. Buraschi is at the University of Chicago Booth School of Business and Imperial College London; Carnelli is at Imperial College London; and Paul […]

Europe: Is the worst over? Part II.

“Deleveraging takes a long time, and it is painful,” said Philippe Ithurbide, Global Head of Research, Analysis and Strategy at Amundi Asset Management. In the second part of his presentation to the CFA Society Toronto on November 19, 2013, he discussed solutions to European financial difficulties. Deleveraging must be helped along in order to shorten the time and reduce negative socioeconomic impacts. “Never in history have we seen the deleveraging of all the players at the same time.” “Banking credit is faltering everywhere in the euro zone,” said Ithurbide. Euro zone bank credit is still highly fragmented by nation, with […]