Ethical Decision Making

Why do well-meaning people engage in unethical behavior? Given that a healthy financial market depends on trust, and that trust is earned through ethical behaviour, ethics are fundamental to ensuring the integrity of finance professionals. A panel of two experts in ethical decision making from the CFA Institute—Jon Stokes, Director, and Paul Johnson, Manager and Special Investigator—spoke live to an audience of about 700 on October 21, 2020 in celebration of Global Ethics Day 2020. A survey of 3500 retail investors showed which industry sectors they ranked as “highly trustworthy.” Medicine was at the top of the list, with 68 […]

Psychology of Money

In 2009, award-winning journalist Morgan Housel was awash in information about the 2008 financial collapse. Yet, try as he might, he could not find the answer to the question: “Why did people behave the way they did?” This is what led him to start formulating notes for what became a blog, and eventually a book titled The Psychology of Money: Timeless lessons on wealth, greed, and happiness (Harriman House, 2020). The book was launched on September 8. “What is a person’s relationship with greed and fear? The psychological side of investing is the most important side,” Housel said, “because if you […]

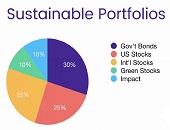

Investing in the greater good

Every day, more investors are converting their portfolios to socially responsible investing (SRI). But does being a socially responsible investor mean you will take a hit on performance? “Over the last five years, responsible investments have done at least as well as the traditional portfolio,” said Tim Nash, a fee-for-service financial planner who spoke at the webinar “Investing in the Greater Good” on August 18, 2020, sponsored by Questrade. Nash is the founder of Good Investing and blogs as The Sustainable Economist. He is also the lead researcher for Ethical Markets Green Transition Scoreboard research report, which details more than […]

Healthy skepticism

Selecting environmental, social, and governance (ESG) funds is a way that ordinary citizens can invest in an ethical way. But what does the increased interest in ESG investing shown by institutional and private wealth clients really mean? Is it paying off? Are we at a watershed moment for structural change in the way investors allocate resources? The move to consider ESG investing came some years ago with scandals such as Enron, and continues with more scandals such as Volkswagen’s Dieselgate and Facebook’s meddlings, said Pedro Matos, a professor of finance at University of Virginia and the author of the CFA […]

Impact of Covid-19: Economics

How is the world grappling with the Covid-19 Pandemic, especially in the realm of economics? The magazine the Economist presented a webinar on July 30, 2020, titled “The Inside Story: The Impact of Covid-19.” Helen Joyce, executive editor for events at the Economist, interviewed a science writer and an economics editor. This is part two of a two-part summary of that webinar. The second panellist was Henry Cur, an economics editor. He said the economic crisis precipitated by the pandemic is markedly different from “garden variety recessions.” “The scale of unemployment is greater than the 2008 downturn,” he said, “and […]

Impact of Covid-19: Science

How is the world grappling with the Covid-19 Pandemic, especially in the realm of science? Much is happening and the world is hungry for information on these fronts, was the consensus of the panel convened by the magazine the Economist, which presented a webinar on July 30, 2020, titled “The Inside Story: The Impact of Covid-19.” Helen Joyce, executive editor for events at the Economist, interviewed two staffpersons, working on different aspects of the pandemic. She also ran a Q & A session with an audience of thousands via the Zoom platform. This is part one of a two-part summary. […]

Private Equity in “the new normal”

From pandemic to protectionism, global events and trends are having an impact on the private equity (PE) markets. From a Canadian perspective, what effect are these issues having on the alignment between PE investors and PE fund managers? In Toronto on July 9, 2020, Helen Pham welcomed three panellists to the webinar titled, “Private Market Trends: Improving Alignment Between Investors and Managers.” The webinar was organized by the institutional asset management committee of the CFA Society Toronto. The panellists shared their thoughts on how investors should view effects of the global pandemic on private equity markets and the associated risks […]

From brown energy to green

How will climate change affect the financial sector and the broader economy? What policy responses will mitigate climate change risks? Recently, the US Federal Reserve Bank (FRB) sponsored the first conference dedicated to exploring the economic and financial risks associated with climate change. “Climate change will have sweeping effects on our economy and financial system,” says the report summarizing the main themes of the conference. The report, released on December 16, 2019, was co-authored by Galina B. Hale, Òscar Jordà, and Glenn D. Rudebusch. Hale is a research advisor and Jordà and Rudebusch are both senior policy advisors at the Federal […]

Machine learning sniffs out corruption

“Bribery and corruption are by-products of risk culture,” said Aparna Gupta, Associate Professor at Lally School of Management at Rensselaer Polytechnic Institute. “We can take a step back and devise methods to detect it using textual data and machine learning.” Gupta was the second of two speakers at the one-hour webinar “Corruption and Corporate Governance” sponsored by the Global Association of Risk Professionals (GARP) on October 30, 2019. Since culture is intangible, empirical work on the relation between risk culture and risk management is limited. Traditional approaches for assessing risk culture have many drawbacks such as bias and lack of comparability. Nonetheless, […]

More Leaves than Grapes?

Who says the market on old books is in a downward spiral? Luca Pacioli wrote the definitive treatise Summa de Arithmetica, Geometrisa, Proportioni et Proportionalita and published it in Venice in 1494. On June 12, 2019, Christie’s put up one copy for auction. (The starting price was one million USD; it eventually sold for 1.2 million USD.) Experts estimate 120 copies of this book still exist. An image of a typical page, reproduced here, shows its type font is somewhat less readable than the modern accounting textbook. Summa de Arithmetica was widely read and used at the time. It contains real-life examples, […]