Mega-Platforms, Mega Risk

There’s a world of difference between innovation and disruption. “Think of innovation as doing more, in the same old way,” said Haydn Shaughnessy, innovation specialist and author of Platform Disruption Wave: How the Platform Economy is Changing the World. He presented a GARP webinar on “The Rise of Mega-Platforms and the Risks to Banking” on May 25, 2016. In the first part of his talk, he described mega-platforms. He referred to the thesis of The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail by Clayton Christensen. This book argues that successful companies get so caught up in meeting […]

The Dawn of the Mega-Platform

Disruption of the financial sector is just on the horizon, says Haydn Shaughnessy, author and innovation specialist. He presented a webinar on “The Rise of Mega-Platforms and the Risks to Banking” to the Global Association of Risk Professionals (GARP) on May 25, 2016. His books include The Elastic Enterprise, Shift, and (most recently) Platform Disruption Wave. “What are the consequences of the disintegration of industry structures?” Shaughnessy asked. Most people see innovation as trying to get more of something that’s desirable, he said, but they might not understand clearly where they are headed. In short, what is the “big picture” […]

“Worse Than Silverfish”

Some authors go to great lengths to make their monographs up-to-the-moment. In this excerpt, the authors refer to a popular and critically acclaimed TV series. It’s a calculated risk. They use an obsession of the (fictional) characters—the money they are amassing—to tie into the very real phenomenon of hyperinflation. Today’s excerpt comes from page 103 of the book The Evolution of Money by David Orrell and Roman Chlupaty (Columbia University Press, 2016). “To visualize how hyperinflation can affect one’s personal savings, fans of the TV show Breaking Bad will recall the episode in season 5 in which it is shown […]

The Latest & Greatest

Although the next round of changes to accounting standards will not come into effect until 2018, alert financial analysts should already be asking companies about how they plan to address them, according to Canada’s top accountant. “Pay attention now, because companies do have the option to adopt” and some, such as Canadian banks, are adopting IFRS 9 early, said Linda Mezon, Chair of the Accounting Standards Board (AcSB). She was speaking at a webinar on January 21, 2016, to members of CFA Society Toronto and CPA Canada on the recent developments in accounting standards and emerging trends impacting financial statements. […]

“Feedback Difficult to Obtain”

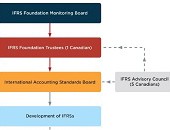

In the financial world, change is a constant. Regulators can barely keep up. Who decides what regulatory changes need to be made? And who can apply the brakes, if a certain type of change is having unintended consequences? Canada’s top accountant briefed the members of the CFA Society Toronto jointly with CPA Canada at a webinar on January 21, 2016. “Feedback is important but difficult to obtain,” said Linda Mezon, FCPA, FCA, who is the Chair of the Accounting Standards Board (AcSB). She summarized how Canadians and the AcSB influence the development of International Financial Reporting Standards. “The Accounting Standards […]

Conference Call Tones. Part 2

Click here to visit Part 1. Interview with S. McKay Price, continued. Q: In the introduction to your paper on textual analysis of conference call tones, you describe a 2012 conference call in which David Einhorn grilled the management team of Herbalife, thereby causing the shares to fall 20 percent in price. Did you run the transcript of this conference call through your call tone algorithm, and if so, was it the most negative sample in the set? 2012 was not in our sample period so we did not specifically create tone measures for that Herbalife call. Although I suppose […]

Conference Call Tones. Part 1

“Spin,” said Morty. “It’s all about spin.” He pointed to the web interface where he was listening to a certain equipment manufacturing company try to explain anomalies in their reported expenses. Like hyenas, the analysts were picking apart the footnotes. Turning to me, Morty said, “These scoundrels are masters of Orwellian doublespeak,” and then he exited the call. About a year later, I chanced upon research that looks into actual word usage during earnings conference calls. Three authors, Paul Brockman, Xu Li, and S. McKay Price, examined transcripts from nearly three thousand such calls. One of the authors is interviewed […]

Swaps, Before & After

“Historically, there were few, if any, regulatory requirements on swaps … it was effectively an unsecured loan,” said James Schwartz, Of Counsel at Morrison & Foerster. He was the fourth and final presenter at the Derivatives Regulatory Update webinar held on March 31, 2015, sponsored by the Global Association of Risk Professionals. Prior to the Dodd-Frank Act, swaps dealers were self-regulated through the trade association International Swaps and Derivatives Association (ISDA). “It was typical for the two parties to accept a certain amount of uncollateralized exposure to each other in the form of a threshold that varied according to their […]

Update on Central Clearing

One of the goals of the Dodd-Frank Act is to mitigate systemic financial risk by establishing a central clearinghouse for derivatives. But how close is the financial community toward achieving that goal? “Many swaps were not collateralized prior to Dodd-Frank,” said Julian E. Hammar, Of Counsel at Morrison & Foerster. Hammar was the third of four presenters at the Derivatives Regulatory Update webinar held on March 31, 2015, sponsored by the Global Association of Risk Professionals. Clearing swaps mitigates risk not just through requiring margin collateral (and thereby reducing) credit risk. It also imposes an “operational discipline” Hammar said, with […]

“Skin in the Game”

What safeguards should be in place, to minimize the risks posed by financial derivatives? CME Group requires that its Clearing Members support the risk of their portfolios by “putting some skin in the game,” said Jason Silverstein, Executive Director and Associate General Counsel of CME Group, a body that includes the Chicago Mercantile Exchange and the New York Mercantile Exchange among its subsidiaries. “It’s a story of balancing incentives, in order to stabilize losses. Our belief is that it should be significant and risk-based.” Silverstein was the second of four presenters at a webinar titled Derivatives Regulatory Update held on […]