8 Ways to Look at Deforestation Risk

“Forests are the lungs of our land, purifying the air,” wrote Franklin D. Roosevelt. Looking at the economic side, what does the loss of forests mean to global markets? “Deforestation is a risk to the supply chain,” said Gabriel Thoumi, Director Capital Markets at Climate Advisers. “It puts billions of dollars at risk.” He was the first of four presenters at the May 4, 2017, webinar sponsored by the Global Association of Risk Professionals. He began with a summary of the activities of Chain Reaction Research, a group which has been actively assessing the sustainability of the supply chains of […]

Environmental Risk: 5 Lessons Learned

“Deforestation causes severe environmental damage,” said Hilde Jervan, chief advisor of the Council of Ethics of the Government Pension Fund Global (GPFG) of Norway. The scale of deforestation of tropical forests is large, and it is occurring within areas that are ecologically important, thereby aggravating the loss of biodiversity. The GPFG has strong ethical guidelines passed by the Norwegian Parliament in 2004. Jervan discussed these in light of the actual example of tropical deforestation. She was the second of four presenters at the May 4, 2017, webinar on Supply Chain Risk due to Deforestation sponsored by the Global Association of […]

Volatility Clustering

When looking at stock market time series, one notices immediately a certain “jitter” or “noise” in the daily returns. This is ordinary volatility. Every once in a while, volatility becomes higher and stays that way—for a while. “Volatility clustering occurs when the volatility of the returns becomes correlated from one day to another,” said Attilio Meucci, CEO and founder of Advanced Risk and Portfolio Management (ARPM). He was the sole presenter at the May 11, 2017, webinar on Modeling and Forecasting Volatility Clustering sponsored by the Global Association of Risk Professionals. Meucci began by showing an example of volatility clustering […]

A Moving Target

When it comes to changing the Dodd-Frank Act (DFA), the new Trump administration “may find repeal and replace is not really a good strategy,” said Tim McTaggart, partner at Stinson Leonard Street, LLP. He was the second of two presenters during the webinar on planned changes to the Dodd-Frank Act, April 27, 2017, timed to coincide with the 100th day since Donald Trump became U.S. president. The webinar was sponsored by the Global Association of Risk Professionals. The changes could involve a reconfiguration or readjustment of the regulatory process, coupled with “some really interesting personnel appointments,” McTaggart said. It’s a […]

The First 100 Days

In the first 100 days of the Trump presidency, has financial risk increased, decreased, or stayed the same? “One of the key platforms of the Trump administration was a promise to dismantle the Dodd-Frank Act,” said Candice Nonas, managing consultant at Resources Global Professionals. “What will be the impact of repeal on consumer protection?” She was one of two presenters during the one-hour webinar sponsored by the Global Association of Risk Professionals on April 27, 2017, which is the 100th day since Donald Trump became U.S. president. Nonas noted that the Dodd-Frank Act is actually an amalgam of several pieces […]

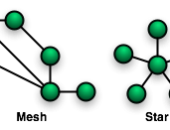

Central Clearing Design

If you had to design a central clearinghouse for transactions in financial markets, what size of guarantees should be offered? And what percentage fees should be charged? “The central clearing modifies the market,” said Andreea Minca, “because the old network structure [of one-to-one] is changing to a new ‘star’ structure.” Minca is Assistant Professor at the School of Operations Research and Information Engineering at Cornell University and was the sole presenter at the December 6, 2016, webinar on systemic risk and central clearing design to members of the Global Association of Risk Professionals (GARP). Under new US legislation, all over-the-counter […]

Clash of Titans

In the wake of the financial crisis, the two Titans that create accounting standards tried to hammer out agreement over how to account for impairment of loans. These bodies are the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB). “FASB and IASB share the same goal but unfortunately were not able to agree on the same standard,” said Emil Lopez, Director of Risk Measurement at Moody’s Analytics. FASB calls their impairment standard “current expected credit losses” (CECL) whereas IASB deals with impairment and expected losses in their International Financial Reporting Standards as IFRS 9. Lopez was […]

Move Beyond Spreadsheets

Is your firm ready? Financial institutions are seeking answers that will help them plan a roadmap for implementation of the new current expected credit losses (CECL) standard issued by the Financial Accounting Standards Board (FASB). “The runway looks long but firms need to start to prepare now,” said Anna Krayn, Team Lead for Impairment, Capital Planning and Stress Testing at Moody’s Analytics. She was the second of three panellists at the webinar “The Long Road to CECL” sponsored by the Global Association of Risk Professionals on September 8, 2016. “Now is the time to educate, organize and govern, quantify, and […]

Long Road, Many Challenges

Nothing like a financial crisis to show the rough spots in estimation of losses. “Credit losses weren’t being recognized on a timely basis,” and the impairment accounting models were complex and varied widely, according to Kevin Guckian, Partner, National Professional Practice at Ernst &Young. He was the first of three panellists at the webinar “The Long Road to CECL” sponsored by the Global Association of Risk Professionals on September 8, 2016. “FASB’s final standard should accelerate recognition of credit losses,” Guckian noted, referring to the current expected credit losses (CECL) standard newly adopted by the Financial Accounting Standards Board. He […]

Avoid Jekyll and Hyde

Accurate price determination for commodities means that data must be gathered, processed and analyzed. What, then, are current best practices for data management? “Organizations are beginning to recognize their current solutions are no longer meeting current needs,” said Michal Peliwo, Vice President of Business Solutions at ZE PowerGroup. He was the third and final speaker at a webinar on August 24, 2016, sponsored by the Global Association of Risk Professionals, titled “The Price is Right? Strategies for Market Discovery & Optimum Pricing Challenges.” Peliwo described the fragmented world of data management as it exists at most companies. “MS Excel is […]