Risk Data Aggregation & Risk Reporting. Part 2

“Not everything that can be counted counts,” said Mike Donovan, VP, Strategic Risk Analytics & Credit Portfolio Management at Canadian Imperial Bank of Commerce (CIBC). He was the second speaker to address the September 19, 2013 evening meeting of the Toronto chapter of GARP regarding the set of Principles for Effective Risk Data Aggregation & Risk Reporting released by the Basel Committee in January 2013. CIBC, like other Canadian banks, is adapting to the heightened risk management data requirements and building the foundation for future sustainable growth. Donovan used the opening quote by Einstein to remind the audience that big […]

Risk Data Aggregation & Risk Reporting. Part 1

During the throes of the last financial crisis, banks and regulators alike “struggled” to get good quality information. “The infrastructure was not there,” said James Dennison, CFA, Managing Director, Operational Risk Division, Office of the Superintendent of Financial Institutions (OSFI). To enhance banks’ risk management infrastructure, the Basel Committee on Banking Supervision (BCBS) released a set of Principles for Effective Risk Data Aggregation & Risk Reporting in January 2013. Dennison was first to speak on the evening of September 19, 2013 at the Toronto chapter meeting of the Global Association of Risk Professionals (GARP). It was convened at First Canadian Place to allow […]

Basel III and Beyond: Capital Management and Funding Strategies

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]

Risk Models From Governance to Validation: Part 2. A Model of Model Management

No longer should a firm just use financial models; it should have a “model of model management,” said Donna Howe, Chief Risk Officer at Sovereign Bank. She was the second of three speakers at a June 11, 2013 webinar on risk models organized by the Global Association of Risk Professionals (GARP). Such a “meta-model” would help a firm sort and track models. Howe said that risk models must be understood within the wider frame of compliance and other non-prudential risk. Model parsimony, or Occam’s razor, that was recommended by the first speaker, is good but in the real world “cannot […]

Risk Intelligence for Value Creation: Part 2. The New Efficient Frontier

“Risk intelligence is the new efficient frontier,” said Philippe Carrel, author of The Handbook of Risk Management: Implementing a Post-Crisis Corporate Culture (2010) [Cover shown]. He was the second of two speakers on May 28, 2013 at a webinar organized by the Global Association of Risk Professionals (GARP). He went on to explain the connection between risk-adjusted performance and the elaborate information network that is “risk intelligence.” “Balancing shareholder’s value with risk exposure depends on a firm’s assessment of its aggregate sensitivity to risk and its ability to act on it,” Carrel said. “A firm builds its corporate memory as […]

Risk Intelligence for Value Creation: Part 1. The Levers in the Cockpit

The strategic focus of financial executives and institutional investors must be risk intelligence, not just risk management, according to Leo Tilman, President of Tilman & Company, author, and adjunct professor of finance at Columbia University. He was the first speaker on May 28, 2013 at a webinar organized by the Global Association of Risk Professionals (GARP). In the words of Peter Drucker, institutional investors must understand “the future that has already happened.” Tilman said investors need to have a vision for growth and relevance in the low growth, low return environment post-2007. “Does a firm have a holistic framework for […]

How New Regulations Are Breaking Down Silos. Part 1: Stress Testing

“Financial regulators have introduced stress testing as a means to cut across silos,” said Dan Travers, VP of Product Management, Adaptiv at SunGard and the opening speaker at a GARP webinar on May 21, 2013. Historically, he noted, financial risk has been treated as a set of separate units (or silos) across the main types of risk: credit, market, operational, and liquidity risk, the latter connected to asset-liability management (ALM). The new reporting demands of Basel III and Dodd-Frank serve to break down silos, Travers said, with such things as incremental risk charge being reported as capital percentage for the […]

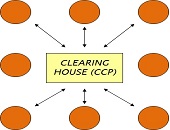

Evolution of the OTC Swaps Markets. Part 2: Lessons Learned

The scramble to meet the Phase 1 deadline of new regulations on swaps “was a significant learning experience,” said Bis Chatterjee, Global Head of E-Trading, Credit Markets at Citi. He was the second speaker in a webinar panel organized by the Global Association of Risk Professionals (GARP) on May 14, 2013. The deadline that came into effect March 11, 2013 pertained to the Dodd-Frank Act governing over-the-counter (OTC) swaps. (Two more phases will follow; see Part 1 for details.) There were challenges first of all, Chatterjee said, in the self-identification of market participants in Phase 1. Second, even if you […]

Spotting Signs of Poor Corporate Governance. Part 2: ESG Management

Corporate governance is only one part of an overall phenomenon known as “ESG management,” or how a company handles environmental, social, and corporate governance (ESG) issues. “Research shows that companies that disclose more ESG information are more likely to enjoy a lower cost of capital,” said Max Zehrt, Senior Manager at Sustainalytics. He was addressing a noon-hour seminar of financial analysts and portfolio managers on the subject of corporate governance on May 8, 2013 at the offices of the CFA Society Toronto. His talk was the second part of a two-speaker panel moderated by Toby Heaps of Corporate Knights. Zehrt was […]

Measuring the ROI of GRC. Part 1: “Your Mileage May Vary”

When looking at the return on investment (ROI), “it’s not about getting the highest number—it’s what is most defensible,” said Hyoun Park, Principal Analyst at Nucleus Research. Park was speaking on March 28, 2013 to a webinar audience on the topic of how to quantitatively measure the ROI on governance, risk assessment, and compliance (GRC). The two-speaker panel, convened by the Global Association of Risk Professionals (GARP), based their remarks on a study released in October 2012 by Nucleus Research (cover shown here). The report states “this research was conducted in context of the usage of IBM OpenPages, a software […]