Europe: Is the worst over? Part I.

“The US had one financial crisis in 2008, but Europe has had two crises—2008 and 2011,” said Philippe Ithurbide, Global Head of Research, Analysis, and Strategy at Amundi Asset Management. He was addressing members of the CFA Society Toronto that had gathered in the TMX Group Centre in downtown Toronto on the evening of November 19, 2013 to hear an overview of European market trends. The first half of his talk was a comprehensive quantified description of the financial woes of the euro zone, followed by several proposed solutions and investments strategies in the second half. In the quarters since […]

China: Global Leader, Threat, or Both? Part 2.

“The likelihood of conflict is low but non-negligible” when it comes to China’s perspective on Japan’s re-militarization, said Daniel Wagner, CEO of Country Risk Solutions, during the second half of his Global Association of Risk Professionals webinar on October 22, 2013. After surveying Sino-American relations in Part 1, Wagner guided the audience through an in-depth look at China’s evolving geopolitical position in Asia and Africa. Japanese Prime Minister Shinzo Abe has raised military spending, loosened constitutional constraints on military action, and given a high profile to the Senkaku Islands dispute. Sabre-rattling occurs, but Wagner doubts that China and Japan would […]

China: Global Leader, Threat, or Both? Part 1. China and US

“Hide one’s brilliance, bide one’s time” seems the most fitting aphorism for China’s global strategy, said Daniel Wagner, CEO of Country Risk Solutions. During an hour-long webinar on October 22, 2013 organized by the Global Association of Risk Professionals, Wagner guided the audience through China’s evolving geopolitical position generally, as well as its relationships with US, Asia, and Africa. China is in the ascendant mode, said Wagner, citing the increasing use of the yuan as a reserve currency, as well as its rising military power. Regaining global dominance would be “like picking up where they left off,” he said, reminding […]

Modeling Sovereign Risk. Part 2: Quantification

“The Bloomberg sovereign risk model starts by dividing countries into two types,” said Rajan Singenellore, “reserve-currency countries and non-reserve currency countries. Everything else depends on that distinction.” Singenellore is Product Manager, Risk & Valuations at Bloomberg and was the second of two speakers to address a GARP webinar audience on September 12, 2013. A reserve-currency country is one whose currency is held in significant quantities by other governments as part of their foreign exchange reserves, such as the US and the Japan. There is a pressing need for quantification in the area of sovereign credit risk, he said, citing as […]

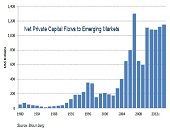

Modeling Sovereign Risk. Part 1: Emerging Markets

“Country-specific factors such as government debt and the sovereign credit rating change slowly but global aggregates such as the risk appetite change quickly, thus leading to confusion the part of observers,” said Michael Rosenberg, Foreign Exchange Consultant, Bloomberg and author of Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination. He was the first of two speakers to address a GARP webinar audience on September 12, 2013. Much of Rosenberg’s talk focused on the sovereign credit risk of emerging markets (EM), because the accelerating flow of net private capital into EM from 1980-2014 has been unprecedented. […]

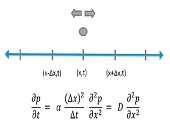

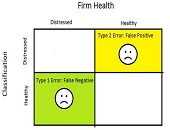

Quant Chalkboard: Data, Models & Concepts

“People are more likely to believe something that comes as data,” said Joe Pimbley, Principal, Maxwell Consulting, “but you shouldn’t necessarily believe the data.” Pimbley, a lead investigator for the examiner appointed by the Lehman Brothers bankruptcy court, addressed financial risk management professionals at a GARP webinar on August 6, 2013. [Ed. Note Click here to read Joe Pimbley – “Why Lehman Brothers Failed When It Did” on Stories.Finance.] Pimbley said that model builders must always look at data with the eyes of a skeptic. With a PhD in physics he is conversant with models devised to predict the “real world” and […]

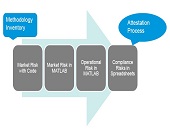

Risk Models From Governance to Validation: Part 2. A Model of Model Management

No longer should a firm just use financial models; it should have a “model of model management,” said Donna Howe, Chief Risk Officer at Sovereign Bank. She was the second of three speakers at a June 11, 2013 webinar on risk models organized by the Global Association of Risk Professionals (GARP). Such a “meta-model” would help a firm sort and track models. Howe said that risk models must be understood within the wider frame of compliance and other non-prudential risk. Model parsimony, or Occam’s razor, that was recommended by the first speaker, is good but in the real world “cannot […]

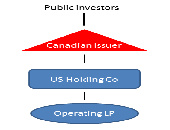

Foreign Asset Income Trusts

“Income trusts should be viewed as a story in capital markets innovation,” said Jon Northup of Goodmans LLP. He was speaking at a luncheon at the National Club in Toronto, sponsored by the Chartered Financial Analysts (CFA) Society Toronto on March 5, 2013. The introduction of SIFT (Specified Investment Flow-Through) rules by the Canadian government in October 2006, “effectively eliminated Canadian income trusts,” Northup said. There are two exceptions: (1) a trust that does not involve Canadian real estate, immovable or resource properties used in carrying on a business and (2) a trust that qualifies as a REIT (real estate […]

The Fed, Foreign Banks and Basel III: Part 2. Capital Concerns

“Some of the rules are in direct conflict,” said Peter Went, VP, Banking Risk Management Programs, GARP. He was the second speaker at a webinar presented on February 14, 2013 organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. The “conflict” refers to rules in the Dodd-Frank Act versus the globally agreed Basel III Accord’s guidelines. Both regulatory attempts apply the G-20 principles on financial regulation (Pittsburgh 2009 summit). The US implementation of the Basel III framework differs from the […]