Stress Testing Mortgages. Part 1

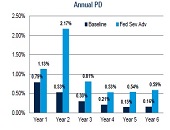

“One needs to be careful and not over-reliant on any one model,” said Scott L. Smith, Associate Director for Capital Policy at the Federal Housing Finance Agency (FHFA). He was referring to the financial models used by major financial institutions to estimate potential losses. On February 4, 2015, he was presenting a GARP-sponsored webinar on countercyclical stress tests to set capital requirements. Smith explained how credit risk is measured for mortgages, and described a way to embed stress testing that uses countercyclical concepts. He and colleague Jesse Weiher, Senior Economist at FHFA, performed dynamic stress testing that was adjusted to […]

Stressed Interest Rates: Battle of the Models

For generating shocked interest rate curves, such as a sudden economic stress might engender, “a three-factor parameterization solves many problems—but issues remain,” said Alexander Bogin, Senior Economist at the Federal Housing Finance Agency, and the second presenter at a webinar on modelling interest rate shocks held October 28, 2014, and sponsored by the Global Association of Risk Professionals. To develop an improved yield curve approximation, Bogin showed three variants of non-linear Laguerre functions of time to maturity. These were the Nelson-Siegel model (which has 3 factors); the Svensson model (4 factors); and the Björk-Christensen model (5 factors). Over a two-year […]

Stressed Interest Rates: ‘Simple’ Not Good Enough

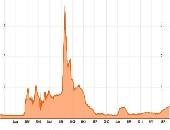

“It’s difficult to apply historical down-shocks to the current low interest rate environment,” said Will Doerner, “and models have problems in the low interest rate environments of today.” Doerner is Senior Economist at the Federal Housing Finance Agency (“Agency”), and was the first presenter at a GARP webinar on how to generate historically-based interest rate shocks, which was held October 28, 2014. An accurate estimation of market risk helps financial institutions determine the amount of capital needed to withstand adverse market events. Interest rate changes represent a key factor for institutions with large fixed income portfolios. As such, when stress […]

DFAST 2. Challenges of Modeling Credit Risk

There are multiple challenges to private firm commercial & industrial (C&I) risk management, according to Mehna Raissi, Director, Enterprise Risk Solutions at Moody’s Analytics. She was the second of two speakers at a GARP-sponsored webinar on September 9, 2014, to address the Dodd-Frank Act Stress Test (DFAST). Successful risk management depends on three things: the potential for error within standardized processes; ongoing monitoring of counterparty credit risk; and the efficacy of credit risk models. A very big challenge is data quality and availability. “What are the types of variables and factors needed?” Raissi asked. “How can we take into consideration […]

DFAST 1. Modeling Losses and Provisions Over Time

Although Dodd-Frank Act Stress Testing (DFAST) requirements may be the primary motivation for bringing stress testing to the forefront, they should not be the only reason a bank explores the components of loan loss forecasting under a stressed scenario, said Chris Henkel, Senior Director, Enterprise Risk Solutions at Moody’s Analytics. He was the first of two panelists at a webinar held on September 9, 2014, sponsored by the Global Association of Risk Professionals. An accurate forecast of charge-offs is crucial, Henkel said, so that a firm “can estimate what allowances should be and how large the provisions should be,” thereby […]

Model Risk 2. Look Beyond the Numbers

What does the near-disaster on London’s Millennium Bridge have to teach us about model risk? “The bridge, inaugurated with great fanfare by the Queen in 2000, filled with people and began to sway so strongly it had to be immediately shut down,” said Ravi Chari, Manager, Americas Risk Practice at the SAS Institute. “When the bridge was modelled during development, the developers did pose the question ‘what is the probability of 10,000 people walking in unison on the bridge?’ And the answer was ‘practically zero’—but that’s exactly what happened on Day One!” Chari was the second of two speakers on […]

Stress Testing, Part 2: Data, the River

A common theme throughout contemporary financial stress testing is “data, the risky river,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group. He was the second of two speakers to address issues around data in stress testing in a webinar organized by GARP on January 28, 2014. The recent financial crisis has permanently altered the relationship between the central bank and all other financial institutions, said O’Connell. The central bank is now looking at them as potential customers for a line of credit, and thus must carry out due diligence including asking for proof that the financial […]

Stress Testing, Part 1: The Data Mountain

Demands by regulators for increased frequency of reporting and more granularity of data in financial stress testing “are creating a data mountain,” said Jon Asprey, VP Strategic Consulting, Trillium Software. He was the first of two speakers to address the issue of data in stress testing in a webinar organized by the Global Association of Risk Professionals on January 28, 2014. He contrasted the new demands with early (pre-financial crisis) days of Basel reporting, when the summary level was sufficient. The data mountain has a significant impact on financial institutions, creating “the month-end panic,” Asprey said, since reporting at most […]

Basel III and Beyond: Part 1. Optimization with On-Demand Risk Insights

“The capital consumption of credit counterparty risk has become an issue for banks,” said Rita Gnutti, Head of Internal Model Market and Counterparty Risk at Intesa Sanpaolo. She was the first of two speakers addressing the impact of regulatory developments on counterparty risk assessment. She spoke to a webinar audience arranged by the Global Association of Risk Professionals on June 27, 2013. Gnutti first outlined the new Basel III regulatory framework of credit counterparty risk (CCR), then she described its calculation using internal model methodology (IMM), and third she described the computing and back-testing of CCR carried out by her […]

Basel III and Beyond: Capital Management and Funding Strategies

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]