Who’s Minding the Bots?

Artificial intelligence (AI) is being implemented in nearly all sectors of the economy at an increasing rate. A 2019 survey by Gartner showed that 37 percent of organizations had already implemented AI in some form. When it comes to integrating AI into your company, what are the risks? What are the opportunities? On March 12, 2021, the Industry Relations and Corporate Governance Committee of the CFA Society Toronto convened a panel of experts to look at how effectively a company’s corporate governance can provide proper oversight and avoid mistakes. In other words, “who and how we will mind the bots.” […]

The Data Factory

Annual global spending on alternative data, estimated at US$7 billion in 2020, provides insights to all kinds of industry sectors. How can financial analysts participate in this burgeoning field? On March 3, 2021, the Professional Development Committee at CFA Society Toronto held a second panel discussion on alternative data. Alexandra Zvarich, representing the committee, asked the panellists about the role of alternative data especially in finance, where investors are constantly searching for new sources of alpha. “Alternative data is not new to finance,” said Abraham Thomas, Chief Data Officer and co-founder of alternative data firm Quandl. The firm provides financial, […]

Embrace the Alternative

In the world of finance, investors are constantly searching for new sources of information that could help them generate alpha. Many of them have recently turned to alternative data. But what, exactly, is alternative data? And why should investors (and those seeking a career in finance) care about it? On February 17, 2021, the Professional Development Committee at CFA Society Toronto convened a panel discussion to demystify the alternative data industry. Alexandra Zvarich, representing the committee, questioned the panellists about insights they could share, and how to prepare for a career in this area. “We worked with alternative data before […]

From Ideas to Action

Climate change will reshape how financial organizations and investors think about climate-related events. But how will we deal with climate change risk? How will financial organizations respond to increasing demands for transparency, measurement, and action? On February 2, 2021, the Institutional Asset Management Committee of the CFA Society of Toronto convened a webinar with three seasoned experts who discussed how best to move into a world of green initiatives. The session was opened by Brandon Gill, Senior Portfolio Manager, Capital Markets Group, External Public Investments and Credit at OPTrust, the pension trust fund of the Ontario Public Service Employees Union. […]

Find the Needle

With the Covid-19 pandemic still posing challenges to the economy and national health, many financial institutions are making changes to their recruiting mandates. How can they continue to attract the best candidates? How can they mitigate the restrictions of the pandemic when “in person” visits are at the heart of recruitment? “Recruitment is the proverbial case of finding the needle in a haystack,” said Bill Vlaad, President and CEO, Vlaad and Company. “Our job is not to go through hay, but to find the needle.” He was speaking at a webinar on December 17, 2020. The CFA Society Toronto convened […]

The Achilles Heel of Banking

After last decade’s financial crisis, regulators introduced several new measures to reduce systemic risk in the financial system. How are the new safeguards working? What are the implications for future balance sheet structure? The CFA Society Toronto convened a panel of three experts on November 25, 2020, to discuss the new regulatory capital and liquidity frameworks and how they are reshaping the way Canadian banks approach the market. The webinar, including a Q&A session, was moderated by Nigel D’Souza, Investment Analyst, Veritas Investment Research. “There’s no doubt the financial crisis changed balance sheets,” said Bruce Choy, Managing Director (Former Risk […]

Private Equity in “the new normal”

From pandemic to protectionism, global events and trends are having an impact on the private equity (PE) markets. From a Canadian perspective, what effect are these issues having on the alignment between PE investors and PE fund managers? In Toronto on July 9, 2020, Helen Pham welcomed three panellists to the webinar titled, “Private Market Trends: Improving Alignment Between Investors and Managers.” The webinar was organized by the institutional asset management committee of the CFA Society Toronto. The panellists shared their thoughts on how investors should view effects of the global pandemic on private equity markets and the associated risks […]

A Good Start…

Financial risks due to climate change are receiving more attention of late, particularly for investors and regulators, but how far along are firms in addressing the issues? A report on climate risk management at financial firms tabled on June 28, 2019, sponsored by the Global Association of Risk Professionals (GARP), answers the question with its subtitle: “A Good Start, But More Work to Do.” The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP. “Our sample covered 20 banks and seven other financial institutions … from across the globe. These firms have a global […]

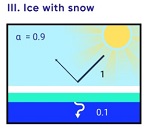

Winds of Change

“Will the greater intensity of climate change expected in Canada produce a greater impact on Canadian financial institutions, and firms that hold a greater proportion of exposure to Canada in its portfolio?” This was the question posed by Robert Thomas, risk consultant to the non-profit organization Ontario Conservation Now as part of a round table held at the Toronto Public Library on April 18, 2019. A report[1] tabled earlier this month by Environment Canada says that climate change will have a greater effect on Canada than on most countries. The report, Canada’s Changing Climate Report 2019 (CCCR2019), looked at observed […]

Origins of Canadian Banking

The financial crisis of 2007-2008 triggered a worldwide recession. The American and European banking systems experienced massive losses, takeovers, and taxpayer-funded bailouts. Lehman Brothers, Northern Rock, European debt crisis, … and the after-effects are still being felt. Canada’s banking system did have some shaky moments, as a recently published analysis of its asset-backed commercial paper (ABCP) predicament showed. On the whole, however, Canada’s banks withstood the financial crisis relatively well and the financial system maintained its liquidity, solvency, and profitability. The history of the divergence in the Canadian and American banking systems is recounted in a new book. From […]