Early Warning Signs

“Overall, the energy sector remains stressed,” said Irina Baron, Associate Director at Moody’s Analytics. Baron was the third and final panellist discussing new dynamics in the handling of financial risk management in the energy sector at a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. Based on expected default frequency (EDF), 75 percent of US publicly-traded companies in the energy sector are not investment-grade risks. “Agency ratings give us a sense of which firms are more likely to default,” she noted. The drawback is that the realized default rate cannot be forecast. However, the expected […]

Managing Risk in Volatile Sector

Market observers have conflicting expectations, especially in the highly changeable energy sector. How can a talented analyst stay on top of it? Mehna Raissi, Senior Director at Moody’s Analytics, was the second of three panellists discussing new dynamics in the handling of financial risk management in the energy sector at a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. “Between 2008 and 2013, we were worried about rising oil prices,” Raissi said. However, “in the second half of 2014, oil prices came down and the headlines read: Recession caused by low oil prices.” Oil prices […]

Volatility Clustering

When looking at stock market time series, one notices immediately a certain “jitter” or “noise” in the daily returns. This is ordinary volatility. Every once in a while, volatility becomes higher and stays that way—for a while. “Volatility clustering occurs when the volatility of the returns becomes correlated from one day to another,” said Attilio Meucci, CEO and founder of Advanced Risk and Portfolio Management (ARPM). He was the sole presenter at the May 11, 2017, webinar on Modeling and Forecasting Volatility Clustering sponsored by the Global Association of Risk Professionals. Meucci began by showing an example of volatility clustering […]

Data Science 2. The Roadmap

“The core concept for data science is hypothesis testing,” said Nima Safaian, team lead for Trading Analytics at Cenovus Energy. The data scientist must identify trends, generate hypotheses, and test, test test. The scientist’s bent toward hypothesis testing should be even stronger than their math skills. Safaian was speaking at the Data Science webinar on August 2, 2016, sponsored by the Global Association of Risk Professionals (GARP). “Attitude is everything,” Safaian said. “Think like a startup. Have an agile mindset,” he urged, referring to the books The Lean Startup by Eric Ries and The Lean Enterprise by Humble, Molesky, and […]

Data Science 1. Trading Analytics

At the end of the day, what do you produce? If you are a knowledge worker, your “product” could be something as intangible and significant as decisions. That is the thinking behind the “decision factories” discussed in Roger Martin’s seminal Harvard Business Review article. If we labour in decision factories, then we are decision engineers, and our chief raw material is data, according to Nima Safaian, team lead for Trading Analytics at Cenovus Energy. “We need the capacity to produce many good decisions,” he said at the webinar on August 2, 2016, sponsored by the Global Association of Risk Professionals […]

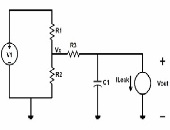

Fast Turnaround of Complex Math

Imagine you are driving your brand-new mini-van, the latest Drake album cranked on high, the windshield wipers at top tempo, and the heater keeping things toasty. You go to switch the headlights to high-beam—and you are suddenly hit by the unmistakable odour of melting circuits…. Not a happy situation. It’s one that automotive designers the world over try to avoid by extensive testing of many different usage scenarios. Problem-solving tools have dramatically changed the way engineers advance their knowledge, for financial, automotive, chemical, and other sectors. Many products and technologies we take for granted—such as the electronic circuitry in a […]

Worst Case Analysis Made Easy

Can symbolic computing improve real-world design? Definitely yes, according to the product development team at the automotive firm Delphi. “Each time the circuits were changed, the electrical equations changed. We turned to symbolic computing so that we could quickly deal with design changes,” said Michael G. McDermott, Senior Development Engineer at Delphi. He was the second speaker in a webinar on May 25, 2016, titled “How Far Can Your Math Knowledge Go?” Lights, heating, movies for kids in the back to watch… Over time, vehicles have come to have more and more elaborate electronics. These can lead to unpredictable stresses […]

The Case for Symbolic Computing

Should you care about symbolic computing? If your work involves concepts that are expressed in math, and if you want to reduce errors and routine work, then Samir Khan says, yes, you should. Khan, Product Manager at Maplesoft, was the first speaker in a webinar on May 25, 2016, titled “How Far Can Your Math Knowledge Go?” “Symbolic computing allows you to automatically derive system equations using well-defined rules,” said Khan. “It allows you to mechanize your work with equations, such as the routine manipulations that are done in algebra.” The traditional design process means the designer (or engineer or […]

War, Kidnapping, Data Theft

War, kidnapping, and data theft: Is it some fiction pot-boiler that’s come over the transom? No, it’s the chapter on how the gross domestic product (GDP) came into being in Germany. Today’s excerpt comes from pages 117-8 of the book The Power of a Single Number: A Political History of GDP by Philipp Lepenies, translated by Jeremy Gaines (Columbia University Press, 2016). “[John Kenneth] Galbraith was surprised by the results of his calculations and surveys because they, for the first time, provided a clear picture of the Nazi economy. Because no set of tools comparable to gross national product calculation existed on […]

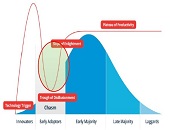

Watch Out for Hippos

Is your company managing risk well enough to make the most of opportunities as they appear? Or does it suffer from risk paralysis? As a company matures, it moves from trying to identify all possible risks (and mitigating them), to saying “what risks will give me the chance to pursue an opportunity,” said Martin Pergler, Founder and Principal of Balanced Risk Strategies, Ltd. He was the first of two panellists at the webinar titled Explore Your Opportunity Landscape by Harnessing Your Risks, sponsored by the Global Association of Risk Professionals on November 18, 2015. Pergler began by making a memorable […]