Conference Call Tones. Part 1

“Spin,” said Morty. “It’s all about spin.” He pointed to the web interface where he was listening to a certain equipment manufacturing company try to explain anomalies in their reported expenses. Like hyenas, the analysts were picking apart the footnotes. Turning to me, Morty said, “These scoundrels are masters of Orwellian doublespeak,” and then he exited the call. About a year later, I chanced upon research that looks into actual word usage during earnings conference calls. Three authors, Paul Brockman, Xu Li, and S. McKay Price, examined transcripts from nearly three thousand such calls. One of the authors is interviewed […]

Liquidity: A Change in Governance

Have you noticed that financial risk managers talk and think differently about liquidity risk, compared to pre-crisis days? The 2007-08 financial crisis was a watershed in the evolution of liquidity management, according to Nicolas Kunghehian, Director Solutions Specialist at Moody’s Analytics. He was the second of three presenters on liquidity risk compliance at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. “Before the crisis, there was only one team dedicated to monitoring and managing liquidity,” Kunghehian said. Liquidity risk was assumed to be small, and the Treasury department was chiefly fine-tuning the profit and […]

Effective Risk Reporting

Effective risk reporting means “having the intelligence at your fingertips but exercising the judgment to report only what your company needs,” said Elizabeth Abraham, Director of Professional Services at MetricStream, and the second of two presenters at the June 16, 2015, webinar on Effective Risk Reporting sponsored by the Global Association of Risk Professionals. “Lack of clarity about the reporting objective” is a common barrier to effective enterprise risk management reporting, she said. Make sure you understand what level of information the audience wants. “Data model inconsistencies can lead to an inability to aggregate” the risk estimates, and that’s another […]

“Not Only The What But The How”

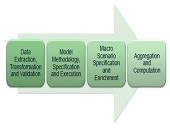

When it comes to financial data for stress testing, there’s a good news-bad news aspect. The good news may be that a bank did not suffer severe financial stress but the bad news is that it will be harder for the bank to model “bad events” if it does not have such data. And banks “will get written up if [the regulators] don’t believe their bad events,” said Tara Heusé Skinner, Manager at SAS Risk Research & Quantitative Solutions, and co-author of The Bank Executive’s Guide to Enterprise Risk Management. She was the first presenter of two at the May […]

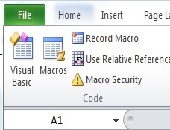

Hum a Few Bars and I’ll Fake It

How far can you go at reducing the tedium in your spreadsheet usage? On May 1, 2015, nearly twenty people attended a day-long seminar “Visual Basic for Financial Professionals,” held on location at the CFA Society of Toronto. The seminar was conducted by Andrew Nikolishyn, CFA, of Vesta Solutions. I often use Microsoft Excel as a scratch pad and a tally sheet, but lately I’ve had to do connected tasks on a regular basis, involving recent financial data. I prepare a graph from the data, and I also run a simple present value calculation, to compare with the previous month’s […]

Better Living Through Topology

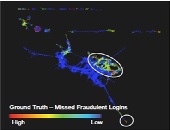

“It gets downright annoying when I’m just trying to check my e-mail but I get prompted to answer three security questions,” said Alexis Johnson, voicing a concern shared by many in the audience when fraud detection is so overblown it obstructs ordinary use of software. Johnson, Director of Technical Sales at the big data analytics firm Ayasdi, was the second of two presenters at a webinar on the topic “The Fraud Arms Race” sponsored by the Global Association of Risk Professionals on April 21, 2015. When it comes to detecting fraud in big data, “data complexity, not volume, is the […]

Stress Testing Mortgages. Part 2

The team of Scott L. Smith, Jesse Weiher, and Debra Fuller at the Federal Housing Finance Agency (FHFA) use specialized financial models to estimate potential losses. They carried out empirical tests of countercyclical shocks using four different models of mortgage credit risk. This posting continues a February 4, 2015, presentation by Scott L. Smith to an audience of financial risk managers at Global Association of Risk Professionals (GARP). Two models were devised at FHFA, and two are commercially available credit models: one, called Black Knight (formerly LPS-AA), and the other called ADCO Loan Dynamics. The estimated losses were converted to a capital […]

Stress Testing Mortgages. Part 1

“One needs to be careful and not over-reliant on any one model,” said Scott L. Smith, Associate Director for Capital Policy at the Federal Housing Finance Agency (FHFA). He was referring to the financial models used by major financial institutions to estimate potential losses. On February 4, 2015, he was presenting a GARP-sponsored webinar on countercyclical stress tests to set capital requirements. Smith explained how credit risk is measured for mortgages, and described a way to embed stress testing that uses countercyclical concepts. He and colleague Jesse Weiher, Senior Economist at FHFA, performed dynamic stress testing that was adjusted to […]

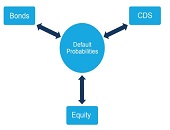

When Data Is Sparse. Part 2

It’s difficult to model sovereign credit risk for emerging markets using structural models such as the Merton model because “calibration is always an issue,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma, continuing a theme during the second half of his webinar on December 2, 2014. During the first half, he showed how the probability of default can be used as a common link among the asset classes of interest (bonds, swaps, and equities). In the second half, he focused more on sovereign credit risk. Calculation of sovereign risk could be done directly, “but […]