Death of Fundamental Analysis?

Have you been following the market frenzy around stocks for GameStop, AMC and Bed Bath & Beyond? Or the news on Wall Street Bets and Robinhood? How disruptive are these events for traditional valuation methods? What new factors must be considered when investing and allocating capital? Recent shifts in market dynamics have altered the perception of capital markets in meaningful ways. On April 8, 2021, the Corporate Finance Committee of the CFA Society of Toronto convened a panel of experts to discuss the reasons market valuations are so out of synch with fundamental analysis. Moderator Stephen Foerster, Professor of Finance […]

Who’s Minding the Bots?

Artificial intelligence (AI) is being implemented in nearly all sectors of the economy at an increasing rate. A 2019 survey by Gartner showed that 37 percent of organizations had already implemented AI in some form. When it comes to integrating AI into your company, what are the risks? What are the opportunities? On March 12, 2021, the Industry Relations and Corporate Governance Committee of the CFA Society Toronto convened a panel of experts to look at how effectively a company’s corporate governance can provide proper oversight and avoid mistakes. In other words, “who and how we will mind the bots.” […]

In Graphic Detail

When trying to present facts and figures to your audience, how can you best convey the information in a memorable fashion? “Through visual presentation,” you might say. Still, this is a very broad area, and it stretches the imagination to devise ways to combine diverse bits of information. It’s a struggle shared by the top practitioners of journalism. On March 4, 2021, two data journalists and an editor from The Economist gave a one-hour behind-the-scenes webinar to discuss the work they do. The Economist was once very skeptical of the need for a data journalism department. Due to the subject […]

The Data Factory

Annual global spending on alternative data, estimated at US$7 billion in 2020, provides insights to all kinds of industry sectors. How can financial analysts participate in this burgeoning field? On March 3, 2021, the Professional Development Committee at CFA Society Toronto held a second panel discussion on alternative data. Alexandra Zvarich, representing the committee, asked the panellists about the role of alternative data especially in finance, where investors are constantly searching for new sources of alpha. “Alternative data is not new to finance,” said Abraham Thomas, Chief Data Officer and co-founder of alternative data firm Quandl. The firm provides financial, […]

Embrace the Alternative

In the world of finance, investors are constantly searching for new sources of information that could help them generate alpha. Many of them have recently turned to alternative data. But what, exactly, is alternative data? And why should investors (and those seeking a career in finance) care about it? On February 17, 2021, the Professional Development Committee at CFA Society Toronto convened a panel discussion to demystify the alternative data industry. Alexandra Zvarich, representing the committee, questioned the panellists about insights they could share, and how to prepare for a career in this area. “We worked with alternative data before […]

Taking Stock

As the covid-19 vaccines continue to be rolled out across the world, how can central banks best counteract the impact of the pandemic? Now might be a good time to pause and reflect on the economic response in Europe. Zanny Minton Beddoes, the editor-in-chief of the magazine the Economist, sat down for an interview with Christine Lagarde, President of the European Central Bank (ECB) on February 10, 2021, to reflect on the challenges Europe faces as it tries to restart its economy while protecting the health of citizens. Lagarde noted the ECB was praised for its quick response in the early […]

Covid Vaccines

“Be careful what you wish for,” the adage goes, “it might come true.” After a year of an ever-broadening pandemic, vaccines have arrived, and thus begins a new round of planning and negotiating. As the first covid-19 vaccines are rolled out across the world, the magazine the Economist assembled a panel on January 14, 2021, to reflect on the challenges. An audience of thousands tuned in as three seasoned journalists discussed global issues related to vaccine development, the risks of misinformation, and the expected impact of an uneven distribution process of vaccines. The panel moderator was Helen Joyce, executive editor for […]

Climate Risk Survey

Investors continue to ask for more investment strategies that target environment and sustainability. When it comes to capability to manage financial risks due to climate change, how far along are firms in addressing the issues? The second annual global survey of climate risk management at financial firms, sponsored by the Global Association of Risk Professionals (GARP), was presented in a webinar on September 22, 2020. The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP. Paisley began by taking a quick poll of the audience, chiefly GARP members. “Why are you interested in the […]

Psychology of Money

In 2009, award-winning journalist Morgan Housel was awash in information about the 2008 financial collapse. Yet, try as he might, he could not find the answer to the question: “Why did people behave the way they did?” This is what led him to start formulating notes for what became a blog, and eventually a book titled The Psychology of Money: Timeless lessons on wealth, greed, and happiness (Harriman House, 2020). The book was launched on September 8. “What is a person’s relationship with greed and fear? The psychological side of investing is the most important side,” Housel said, “because if you […]

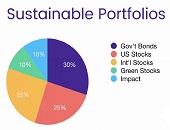

Investing in the greater good

Every day, more investors are converting their portfolios to socially responsible investing (SRI). But does being a socially responsible investor mean you will take a hit on performance? “Over the last five years, responsible investments have done at least as well as the traditional portfolio,” said Tim Nash, a fee-for-service financial planner who spoke at the webinar “Investing in the Greater Good” on August 18, 2020, sponsored by Questrade. Nash is the founder of Good Investing and blogs as The Sustainable Economist. He is also the lead researcher for Ethical Markets Green Transition Scoreboard research report, which details more than […]