Early Warning Signs

“Overall, the energy sector remains stressed,” said Irina Baron, Associate Director at Moody’s Analytics. Baron was the third and final panellist discussing new dynamics in the handling of financial risk management in the energy sector at a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. Based on expected default frequency (EDF), 75 percent of US publicly-traded companies in the energy sector are not investment-grade risks. “Agency ratings give us a sense of which firms are more likely to default,” she noted. The drawback is that the realized default rate cannot be forecast. However, the expected […]

Managing Risk in Volatile Sector

Market observers have conflicting expectations, especially in the highly changeable energy sector. How can a talented analyst stay on top of it? Mehna Raissi, Senior Director at Moody’s Analytics, was the second of three panellists discussing new dynamics in the handling of financial risk management in the energy sector at a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. “Between 2008 and 2013, we were worried about rising oil prices,” Raissi said. However, “in the second half of 2014, oil prices came down and the headlines read: Recession caused by low oil prices.” Oil prices […]

New Dynamics in Energy Sector

How can financial risk be measured and managed in a volatile industry such as the energy sector? What are some of the common industry challenges? Due to low commodity prices and technological changes in the industry, there are new dynamics in the handling of financial risk management in the energy sector. Three speakers addressed specific changes in a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. “Sometimes the things we think we know, we don’t,” said Gordon Goodman of NRG Energy, the first of three speakers at the webinar. Goodman’s claim to fame is publication […]

Volatility Clustering

When looking at stock market time series, one notices immediately a certain “jitter” or “noise” in the daily returns. This is ordinary volatility. Every once in a while, volatility becomes higher and stays that way—for a while. “Volatility clustering occurs when the volatility of the returns becomes correlated from one day to another,” said Attilio Meucci, CEO and founder of Advanced Risk and Portfolio Management (ARPM). He was the sole presenter at the May 11, 2017, webinar on Modeling and Forecasting Volatility Clustering sponsored by the Global Association of Risk Professionals. Meucci began by showing an example of volatility clustering […]

When Data Is Sparse. Part 2

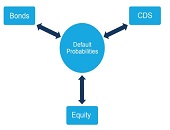

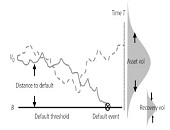

It’s difficult to model sovereign credit risk for emerging markets using structural models such as the Merton model because “calibration is always an issue,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma, continuing a theme during the second half of his webinar on December 2, 2014. During the first half, he showed how the probability of default can be used as a common link among the asset classes of interest (bonds, swaps, and equities). In the second half, he focused more on sovereign credit risk. Calculation of sovereign risk could be done directly, “but […]

When Data Is Sparse. Part 1

When modelling risk in emerging markets, are you hampered by sparse data? “Relationships between different asset classes can help measure the sovereign risk in emerging markets,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma. He was sole presenter at a webinar on December 2, 2014, sponsored by the Global Association of Risk Professionals. When modelling global multi-asset class portfolios, “aggregation can be challenging,” said Stamicar, because the FX rates must also be taken into consideration—the subject for another day. His talk focussed on three asset classes: equity, fixed income, and credit portfolios. Infrequent data, […]

Stressed Interest Rates: Battle of the Models

For generating shocked interest rate curves, such as a sudden economic stress might engender, “a three-factor parameterization solves many problems—but issues remain,” said Alexander Bogin, Senior Economist at the Federal Housing Finance Agency, and the second presenter at a webinar on modelling interest rate shocks held October 28, 2014, and sponsored by the Global Association of Risk Professionals. To develop an improved yield curve approximation, Bogin showed three variants of non-linear Laguerre functions of time to maturity. These were the Nelson-Siegel model (which has 3 factors); the Svensson model (4 factors); and the Björk-Christensen model (5 factors). Over a two-year […]

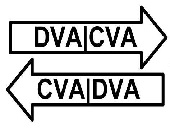

Counterparty Credit Risk 3. Modelling

“Counterparty credit risk is particularly difficult” to model due to its “bilateral nature” and the fact it often covers more than one year, said Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He was the third of three presenters at a GARP webinar on counterparty risk held on May 20, 2014. Singenellore divided the challenges to modelling counterparty risk into three categories. The first, the counterparty’s probability of default (PD), depends on multiple factors and requires estimates of recovery. The second category is how to estimate the future value of securities, which depends on the […]

Counterparty Credit Risk 2. The Good, the Bad, the Ugly, and the Unseen

“Data and its accuracy are key to making this work,” said Robert Scanlon, referring to counterparty credit risk. Scanlon is the former Group Chief Credit Officer of Standard Chartered Bank and current Principal, Scanlon Associates. As the second of three speakers at a GARP webinar on counterparty risk held on May 20, 2014, Scanlon spoke from years of experience with risk practices. First, the good part of calculating counterparty credit risk. Scanlon said there is plenty of data already, especially for consumer/retail transactions. “You can start with a steady state assumption and get more data as time goes on. Ask […]